On March 21st 2022, the US Securities and Exchange Commission (SEC) proposed rule changes requiring public companies to disclose information about climate-related risks relating to their business. This information will need to include details of a company’s greenhouse gas emissions and the impact that climate-related risk could have on the business, operations, and finances.

Climate-related disclosure requirements

The SEC driven proposal, aims to give investors greater insight into a company’s contribution to climate change and the likely impact that climate change could have upon the resilience of the business itself. In their issuing statement, the SEC stated that companies will be required to provide analysis on:

- a business’s governance of climate-related risks

- the likely material impact of climate change on a business for the short-, medium- and long-term

- how climate change may affect present and future business strategy and operations

- the financial cost of physical-climate risks and the transition to a net-zero economy

Providing this information will enable investors to fully understand the possible risks involved, and help issuers more effectively disclose their risks to meet investor demand.

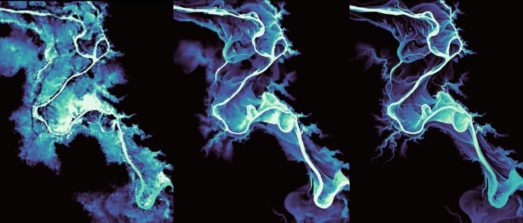

Hurricane Ida Free Data

Download our free event footprint of Hurricane Ida.

Disclosing the impact of severe weather events

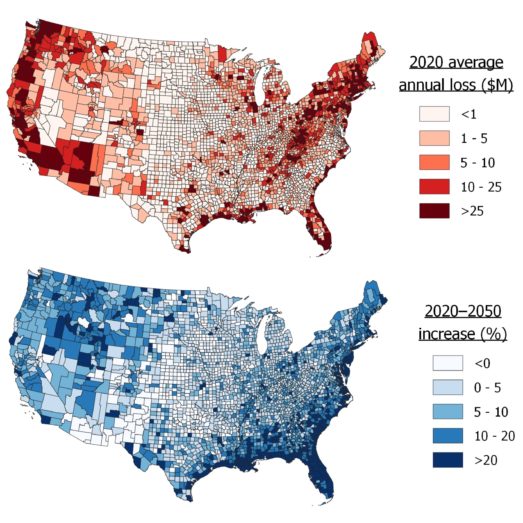

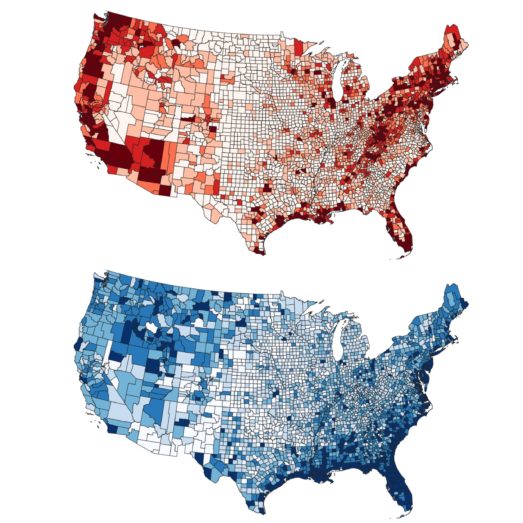

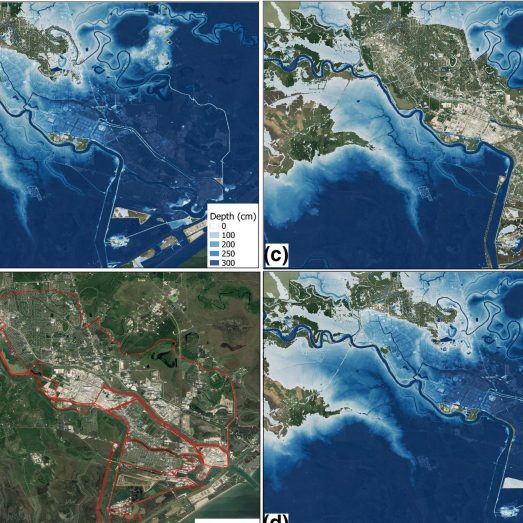

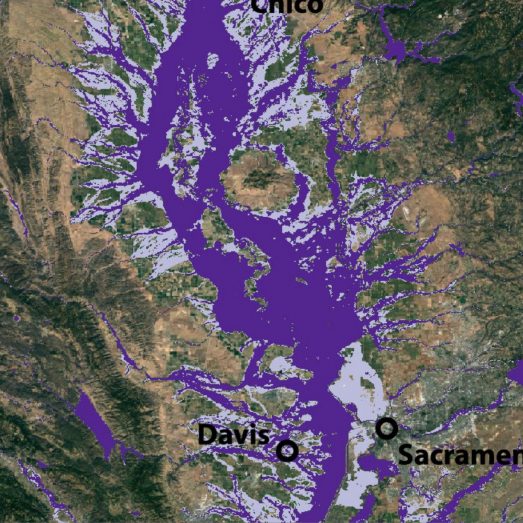

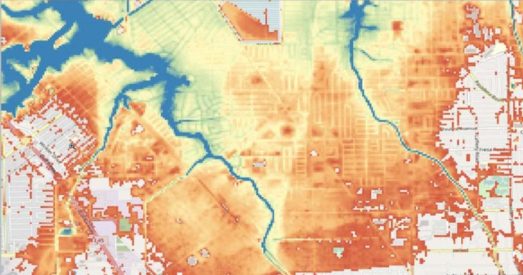

The proposed rule changes include the requirement to disclose the possible impact of climate-related events (severe weather events and other natural conditions). Severe weather events will include, but not be limited to, extreme rainfall, hurricanes, high winds and wildfires. The increased risk of flooding caused by many of these climate-related events, as well as mean sea level rise, has been the subject of much research, including that carried out by Fathom.

Evaluating climate-related flood risk

So how does a business start to identify and evaluate both the likelihood and the impact of such events upon their business?

In the case of flood risk, for businesses that are concerned with only one location, the approach may be fairly straightforward; engage a specialist consulting engineer to build a detailed hydrologic and hydraulic model to represent the likely impact of flooding on both current and future scenarios.

However, when a business has multiple assets (offices, warehouses, treatment works, roads, rail tracks, substations, pipelines, solar farms etc) which could be situated across several states, or the whole US, or which has a geographically disparate supply chain, then this detailed approach is not feasible.

Portfolio analysis for large scale flood hazard

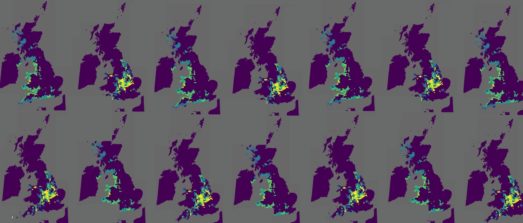

For these kinds of business portfolios, large scale flood modeling approaches are required, and that is where a company like Fathom can help. Fathom’s range of products provide hazard data for different sources of flooding (pluvial, fluvial and coastal) for multiple return periods (1 in 5 year to 1 in 1,000 year) and for current and future climate scenarios.

The data sets are generated using consistent, scientifically proven methods, which are in the public domain. The hazard data is available in GIS format and can be easily combined with company-specific asset data to enable queries to be run across portfolios.

Provision of this large scale flood hazard data allows businesses to concentrate only on the assets that are likely to become at risk from flooding due to climate change. It enables a focused approach on locations where a more detailed analysis is required, which can be undertaken by expert engineering consultants when considering resilience and adaptation to climate change.

Fathom’s open methodology

In addition to being able to provide flood hazard data rapidly, Fathom’s glass box approach to its model development means that any reporting on flood risk due to climate change using Fathom’s data will stand up to scientific scrutiny.

A bibliography of Fathom’s published research can be downloaded here.

What next?

Whilst many of the companies who may be required to provide this information may initially view the proposed changes as an additional financial burden, providing clear reporting guidelines should ensure companies properly assess both their contribution to climate change and start to understand the impact that possible future climate scenarios will have on their assets, their operations and their future resilience. It should also, of course, enable companies to make the changes required to make them more attractive to investors and kinder to the environment.