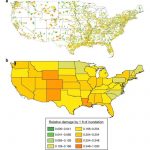

Quantify and measure the economic impact of flooding for a variety of assets, across all 50 states, with Fathom-US CAT

US Catastrophe Model key features

Available through Oasis & Nasdaq—Access the model through a variety of providers including the Oasis Loss Modelling Framework and Nasdaq’s Risk Modelling for Catastrophes platform.

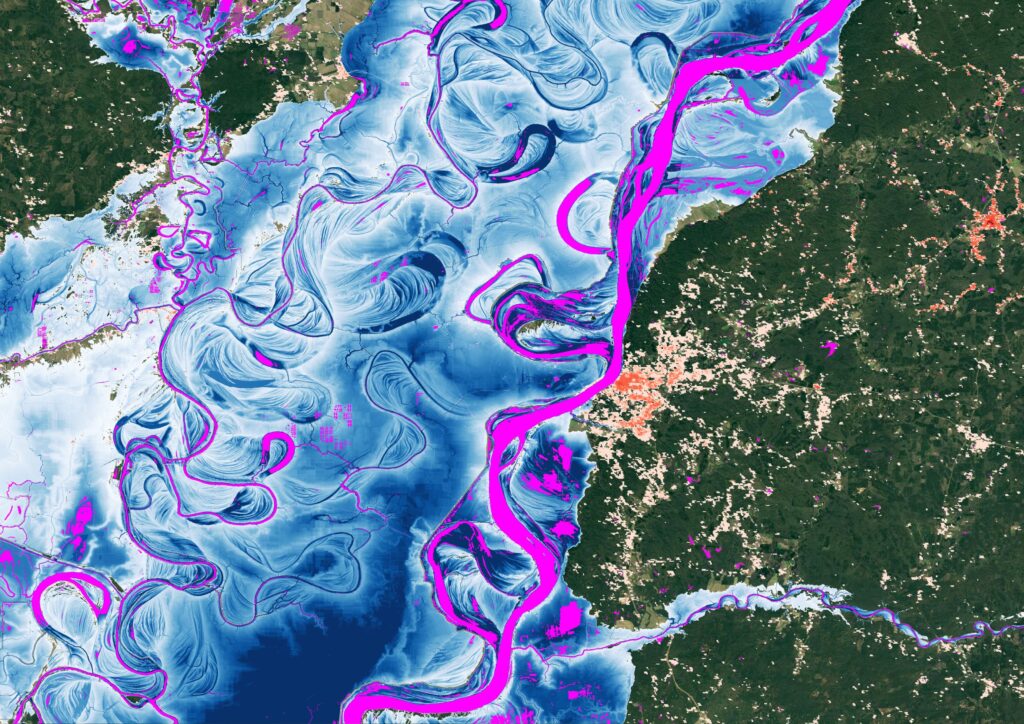

100% of river channels—All river channels, from large rivers to small streams, are explicitly represented.

Inland flooding—Total representation of pluvial and fluvial perils.

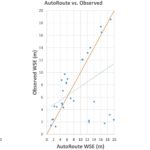

Vulnerability functions derived from National Flood Insurance Programme data—More representative flood losses are modelled using real, measured data from millions of insurance claims.

Defences – Flood defences included.

Hydrography data—Fathom-US CAT uses the latest map of US rivers from the US Geological Survey National Hydrography Dataset.

Fathom’s US Catastrophe Model enables

- Consistent view of risk across the conterminous US.

- Competitive pricing with US wide analysis.

- Realistic loss simulation.

- Evaluation of capital requirements for rare, high-impact loss years.

- Understanding the impact of changes to reinsurance programmes.

- Long-term loss estimates.

- Portfolio management with concentration of risk and impact of diversification.