Sompo

International

Detailed flood hazard information to support risk selection and portfolio management decisions for international insurance subsidiary & Lloyd’s of London insurance syndicate

Sompo International is a leading global provider of property and casualty insurance and reinsurance

Sompo International have operating subsidiaries servicing clients worldwide through platforms in the US, the London Market, Bermuda and Lloyd’s. They required detailed flood hazard information in order to support risk selection and portfolio management decisions for their international property, marine and energy portfolios.

As part of this they wanted to know how they could:

Identify those risks that are exposed to flood hazard and those risks that are not?

Measure and manage aggregations of flood risk in a robust manner across all lines of business?

Achieve this in the most efficient way possible?

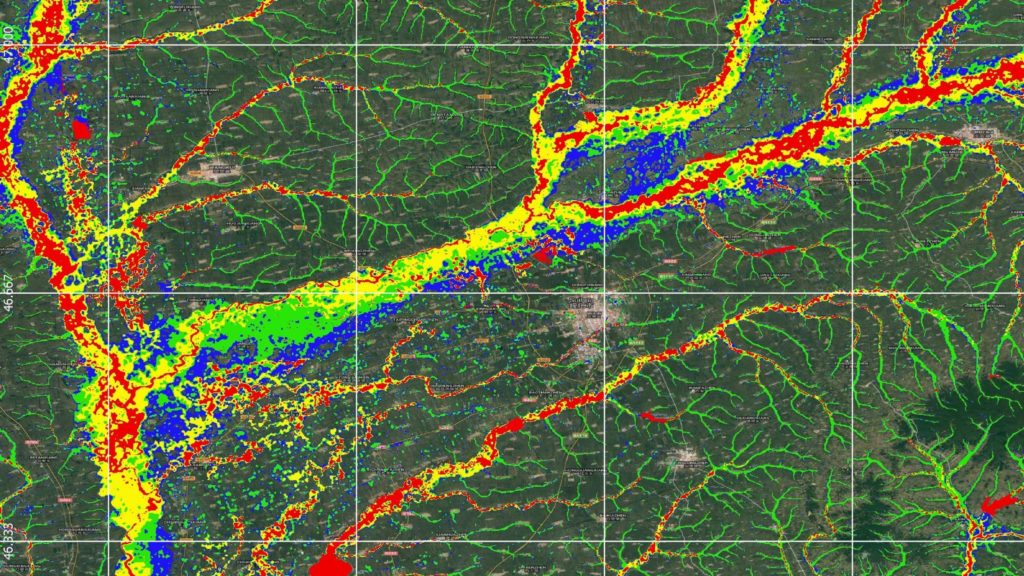

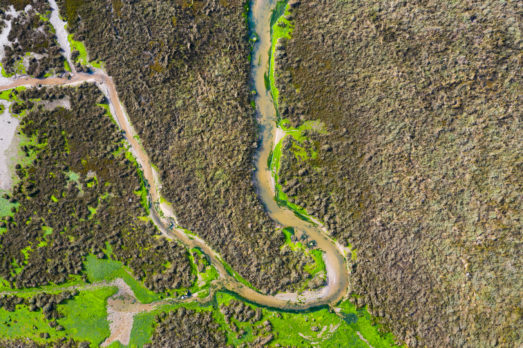

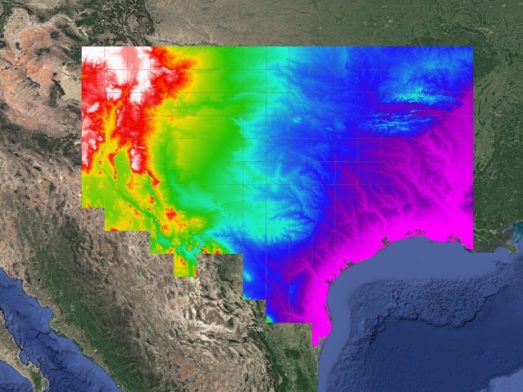

Our Solution Fathom-Global provided detailed, global hazard information for both fluvial and pluvial flood risk for a range of return periods.

The completeness and resolution of this information allowed Sompo International to deploy it in their underwriting workflow in a consistent fashion for all types of risk and across all locations.

Fathom-Global’s flood aggregation zones also allowed them to monitor accumulations and assess the impact of underwriting decisions on the global portfolio.

The Results Flood risk is now a peril analysed by Sompo International using detailed and credible risk intelligence.

This has the potential to improve both underwriting and portfolio management decisions and provides greater certainty in the quantification of a critical catastrophe risk.

The latest Global Flood Map

A step-change in your ability to understand global flood risk.

Related case studies

The Nature Conservancy

The Nature Conservancy worked with Fathom to understand flood risk and identify large scale exposure to flooding across different demographics and the impact of future climate scenarios.

Texas Water Development Board

Texas Water Development Board uses Fathom data, and others, to accelerate the development of the first statewide flood planning program in the absence of publicly available flood data.

Arup & World Bank

Fathom & Arup demonstrate how rapid, data-driven flood modeling can quantify the impact of urban greening on flood extent, soil erosion, and urban heat. Discover how NBS can create more resilient cities.

Bank of England

Fathom supported the Bank of England in their analysis of submissions for CBES 2021 using the Fathom-UK CAT model.

Quote We would like to express our gratitude to both the physical risk open data providers as well as to the plethora of technical experts for all of their contributions to this exercise over the past two years.