Bank of England – Climate Biennial Exploratory Scenarios 2022

Supporting the Bank of England in their analysis of submissions from large general insurers, banks and selected Lloyd’s syndicates

In June 2021, the Bank of England released its final guidance for the Climate Biennial Exploratory Scenarios (CBES).

The exploratory exercise explored the impacts of the physical and transition risks of climate change. With a particular focus on physical risk, the Bank of England’s PRA asked participants to assess their financial exposures for 14 perils, of which flood was included. You can read the full guidance here.

To aid its analysis, the Bank of England approached Fathom and asked them to provide high-resolution flood risk information for the entire UK, under varying climate scenarios.

Fathom’s view of hazard was used alongside other data and permitted the Bank of England to produce a comparative benchmark for their analysis of flood risk returns, which could then be drawn upon when comparing submissions from participating firms.

By working with Fathom the Bank of England were able to:

Compare insurer’s submitted losses against forecasted flood hazards

Understand spatial distribution of losses

Develop a benchmark that could be used as the Bank of England’s “truth”

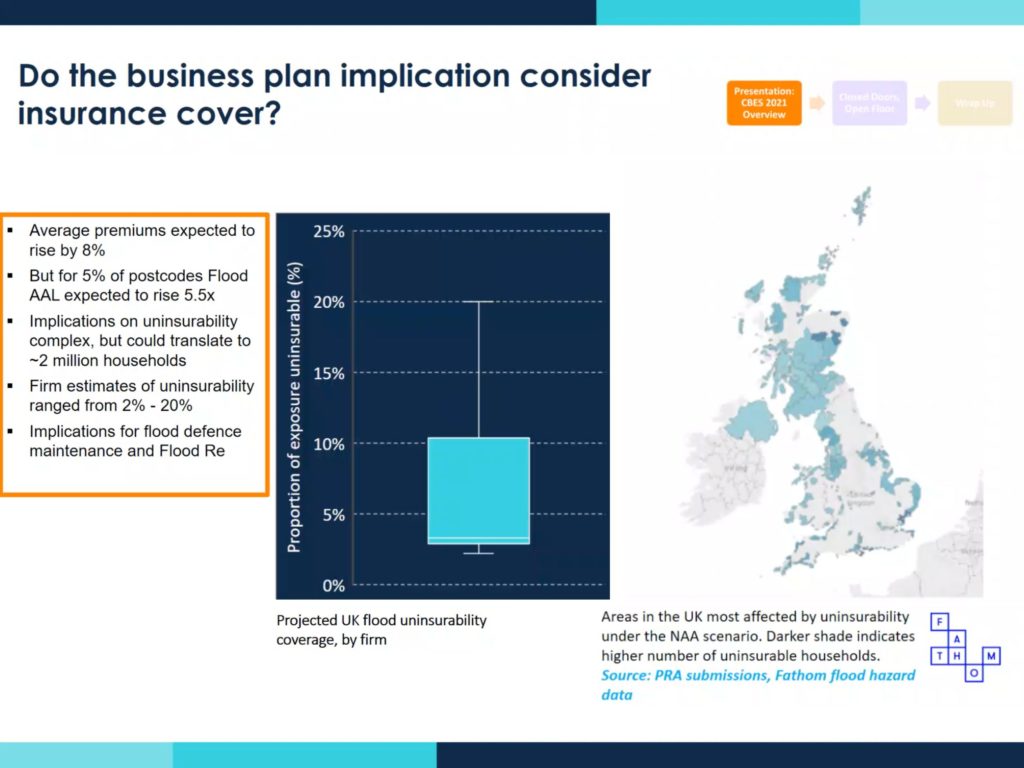

This benchmarking enabled the Bank of England to identify where responses were inconsistent across participating firms and UK geography, with an ambition to highlight areas that are particularly sensitive to the impacts of climate change in order to understand future risk hotspots.

The data used for analysis:

The Bank of England outlined several key requirements as part of the CBES that asked financial institutions to identify, measure and manage financial risks and opportunities from climate change. This included an obligation for participating firms to disclose relative changes in flood risk, alongside quantitative evaluation and questionnaires, for their entire portfolios at a postcode district level.

Fathom’s technical team supported the Bank of England’s ability to benchmark submitted risk assessments by providing flood analysis using the Fathom-UK CAT model. This involved running a sample portfolio against Fathom’s five discrete climate conditioned inland and coastal cat models.

Climate scenarios included:

Fathom UK CAT CBES – Year 0

Fathom’s UK flood model, climate-conditioned to Year 0 (2020) baseline scenario in the Bank of England CBES

Fathom UK CAT CBES – Year 10 (EA / LA)

Fathom’s UK flood model, climate conditioned to Year 10 (2030) of the Early Action and Late Action scenarios in the Bank of England CBES

Fathom UK CAT CBES – Year 10 (NAA)

Fathom’s UK flood model, climate conditioned to the Year 10 (2030) of the No Additional Action scenario in the Bank of England CBES

Fathom UK CAT CBES – Year 30 (EA / LA)

Fathom’s UK flood model, climate conditioned to the Year 30 (2050) of the Early Action and Late Action scenarios in the Bank of England CBES

Fathom UK CAT CBES – Year 30 (NAA)

Fathom’s UK flood model, climate conditioned to the Year 30 (2050) of the No Additional Action scenario in the Bank of England CBES

Losses were aggregated to the postcode district level, with results provided for each sub-peril (pluvial, fluvial and coastal flood). Assessments considered insured average annual losses (AAL), as well as insured 100-year losses for each sub-peril within the five climate scenarios.

Fathom then computed the relative change in risk from the present day for each postcode district, scenario, and sub-peril, and shared these data with the Bank of England.

The Bank of England used Fathom’s results, alongside additional independent datasets for each peril identified in the CBES guidance. This ensured that they were accessing quality-assured, scientifically robust, climate and environmental data and analytics, as advocated by the CGFI. These data underpinned the comparative benchmark used to analyse results shared by participating firms.

Contact usInterested in learning more about how Fathom can support insurers undergoing stress tests or scenario analysis?

Related case studies

The Nature Conservancy

The Nature Conservancy worked with Fathom to understand flood risk and identify large scale exposure to flooding across different demographics and the impact of future climate scenarios.

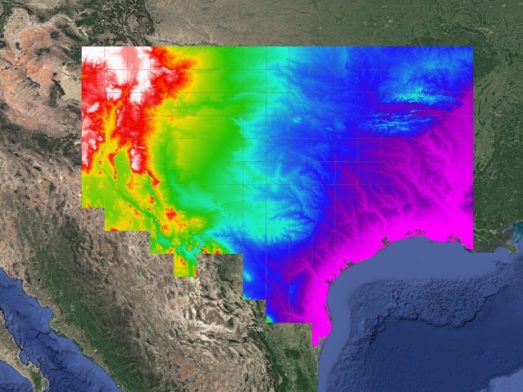

Texas Water Development Board

Texas Water Development Board uses Fathom data, and others, to accelerate the development of the first statewide flood planning program in the absence of publicly available flood data.

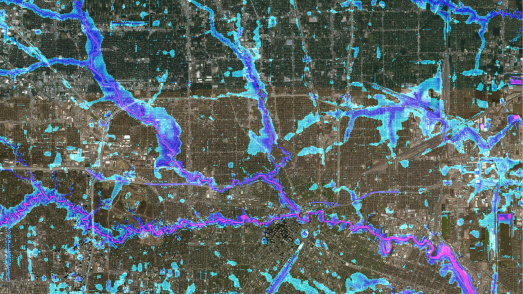

Arup & World Bank

Fathom & Arup demonstrate how rapid, data-driven flood modeling can quantify the impact of urban greening on flood extent, soil erosion, and urban heat. Discover how NBS can create more resilient cities.

Canopius

Global (re)insurer, Canopius, used Fathom-US flood hazard data to quantify their exposure to flooding to inform pricing and facilitate exposure management.