Canopius

Supporting Lloyd’s of London insurance syndicate, Canopius, to quantify their exposure to flood risk in the US

Canopius is a global specialist (re)insurer with a diverse portfolio of assets. With particular emphasis on the United States, Canopius needed to quantify their exposure to flooding in order to inform pricing and facilitate exposure management

In the United States, the FEMA flood maps provide some information, but the data is incomplete and often only includes larger rivers. A more comprehensive overview of risk, outside of state-funded hazard layers, can provide an advantage over competitors.

More specifically, Canopius needed to know:

How do we gain a more comprehensive view of flood risk in the United States?

Are we over-exposed in a particular region?

Can we gain a competitive advantage?

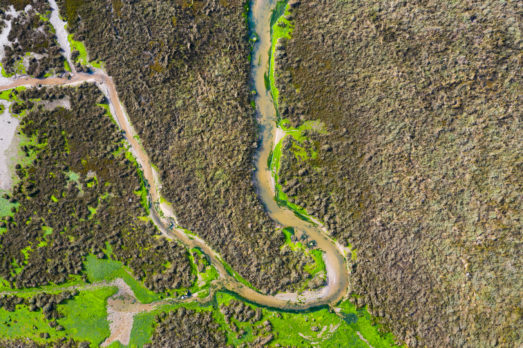

Our solution Fathom have built Fathom-US, a spatially continuous flood model of the US covering both riverine and flash-flood perils

The data have also been published and validated in world-leading journals, providing transparency and trust. Fathom also works closely with their clients to ensure their data are integrated and used correctly, as well as building bespoke tools when required.

The results Canopius now has access to a world-leading flood hazard dataset and tools

This allows them to underwrite new assets and manage their current portfolio with confidence, and, importantly, gain an advantage over competitors.

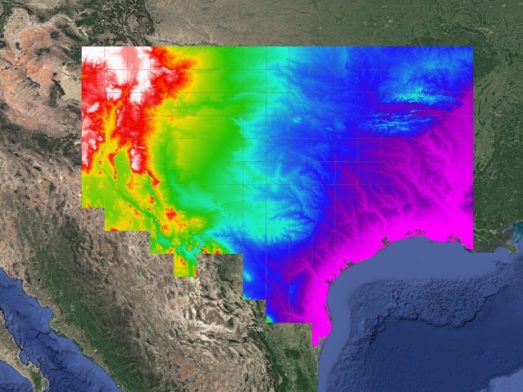

Fathom’s new US Flood Map

The most complete and technologically advanced flood map for the United States.

Related case studies

The Nature Conservancy

The Nature Conservancy worked with Fathom to understand flood risk and identify large scale exposure to flooding across different demographics and the impact of future climate scenarios.

Texas Water Development Board

Texas Water Development Board uses Fathom data, and others, to accelerate the development of the first statewide flood planning program in the absence of publicly available flood data.

Arup & World Bank

Fathom & Arup demonstrate how rapid, data-driven flood modeling can quantify the impact of urban greening on flood extent, soil erosion, and urban heat. Discover how NBS can create more resilient cities.

Bank of England

Fathom supported the Bank of England in their analysis of submissions for CBES 2021 using the Fathom-UK CAT model.

Quote We would like to express our gratitude to both the physical risk open data providers as well as to the plethora of technical experts for all of their contributions to this exercise over the past two years.