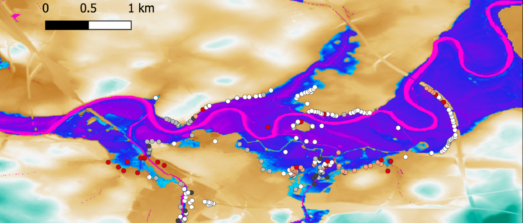

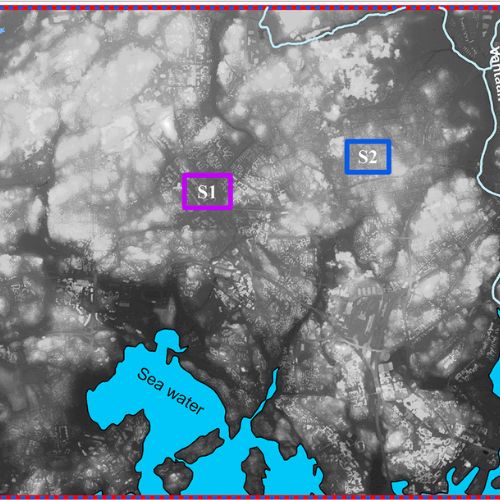

Fathom’s catastrophe models Our catastrophe models represent tens of thousands of years of synthetic flood events. Used primarily by the insurance and corporate sectors, these sophisticated risk prediction tools are able to model losses, from both frequent and extreme flood events, to build a complete picture of flood risk for a given portfolio of locations

Financial losses driven by extreme flood events are increasing annually. In a report published by Swiss Re, the reinsurance company identified a combined economic loss of more than $80 billion in 2021. Of these losses only $20 billion were insured. For professionals looking to quantify and manage flood and catastrophe risk, Fathom offers a range of synthetic flood models, that can help to provide efficient solutions to managing risk and engage with regulatory requirements towards climate risk. This includes a range of climate conditioned catastrophe models that can calculate changes in risk for a variety of time horizons.