Flood risk 01.10.2021

Flood-related events are the most damaging natural hazard in the United States, yet many households at risk do not have flood insurance.

Insurance is mandatory for those residing in FEMA flood zones with a federally-backed mortgage.

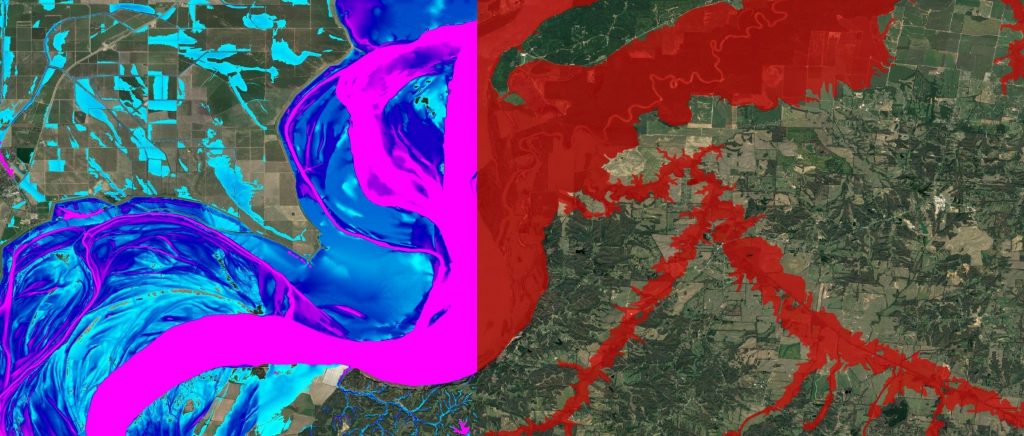

Less understood is what motivates people to voluntarily obtain flood insurance in areas outside these zones. In a wide-ranging analysis in collaboration with Jacob Bradt (Harvard) and Carolyn Kousky (Wharton), we find voluntary insurance purchases are preferentially taking place in areas where Fathom’s model deviates from FEMA flood maps. This implies that our model is correctly identifying places at risk which FEMA misses, and that people have a pretty good understanding (or, at least, better than the NFIP) of their local flood risk, leading to ‘adverse selection’ in the programme.