In this podcast, Fathom’s co-founders join Matthew Grant and the team at Instech to discuss all things flood modeling, founding a business 10 years on and how technology has evolved in recent years

How do you build a successful business from the ground up? What is it like operating within the world of flood mapping and catastrophe modeling? And, how has the emergence of big data analysis and statistical learning methods unlocked new global modeling and predictive capabilities?

In this 25 minute podcast by Matthew Grant, our co-founders Dr Christopher Sampson and Dr Andrew Smith return to the Instech insurehub to cover these themes plus more. This interview follows on from the recent Instech event that we co-hosted with Reask in November, where we explored “Tropical cyclone and flood: managing tomorrow’s climate risk today”.

In this podcast the Fathom co-founders not only talk about their favourite topic, flood modeling, but also reflect on the past ten years of Fathom as a business and how the company has grown.

Covering topics such as:

- The advantages of building a business with close links to a university

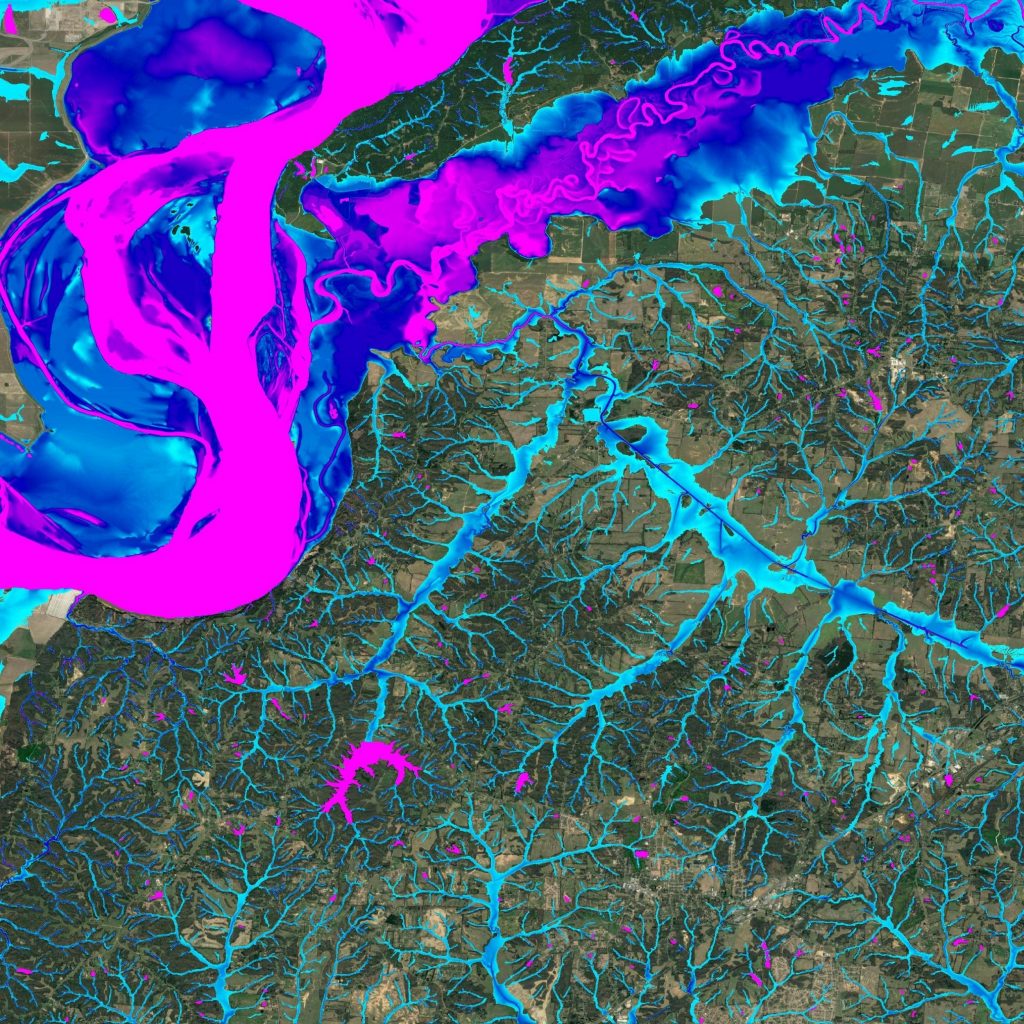

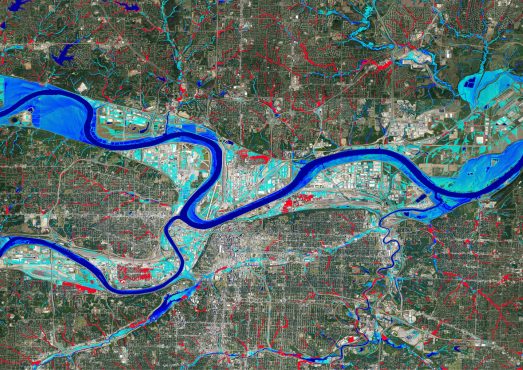

- How increases in the resolution of data and increased computing power have fundamentally changed flood modeling in 10 years

- Why our co-founders made the decision to appoint our CEO Stuart Whitfield

- Why the insurance industry is more advanced in its ability to understanding risk than many other sectors

- How to represent uncertainty in decision making

- How big data and statistical analysis is creating credible data sources that plug the information gaps in global flood modeling

- Working with partners such as Reask

What problem is Fathom trying to solve?

Fundamentally people are trying to understand risk on the ground. For pricing, that’s to understand at a location level what the hazard looks like. Our abilities there have just improved as the data… and the way that we build the models has gotten more sophisticated and gotten better at dealing with the limitations of the data. So in effect, our ability to tell people about their risk at the location level, anywhere in the world has improved in time – making the data more useful to more people…. The thing that we are doing that is a little different, which is why it has taken us a little more time to get to the real portfolio management side of things, is that we are trying to evidence every step of the way to a real flood catastrophe model.

Dr Chris Sampson

Alongside being an interesting listen, chartered listeners can also claim CPD-credits from this podcast. If this is you, podcast learning objectives include:

- Describe some of the advances in data and analytics that are enabling the development of global flood models

- Identity when co-founders should consider bringing in a CEO

- Summarise how insurers compare to other industries in assessing risk.