Fathom CRO Dr Oliver Wing writes for Insurance Insider, discussing how scientific advances will revolutionise flood risk management.

Our Chief Research Officer, Ollie, spoke to Insurance Insider about the need for insurers, planners, and floodplain managers to move away from traditional approaches to quantifying flood risk, and instead adopt emerging “top-down” tools.

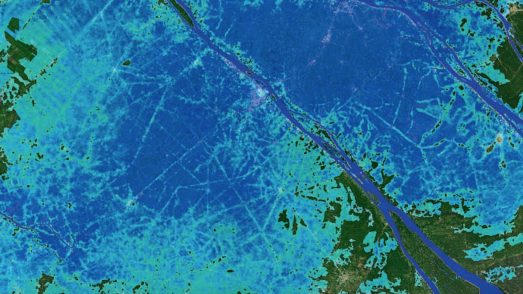

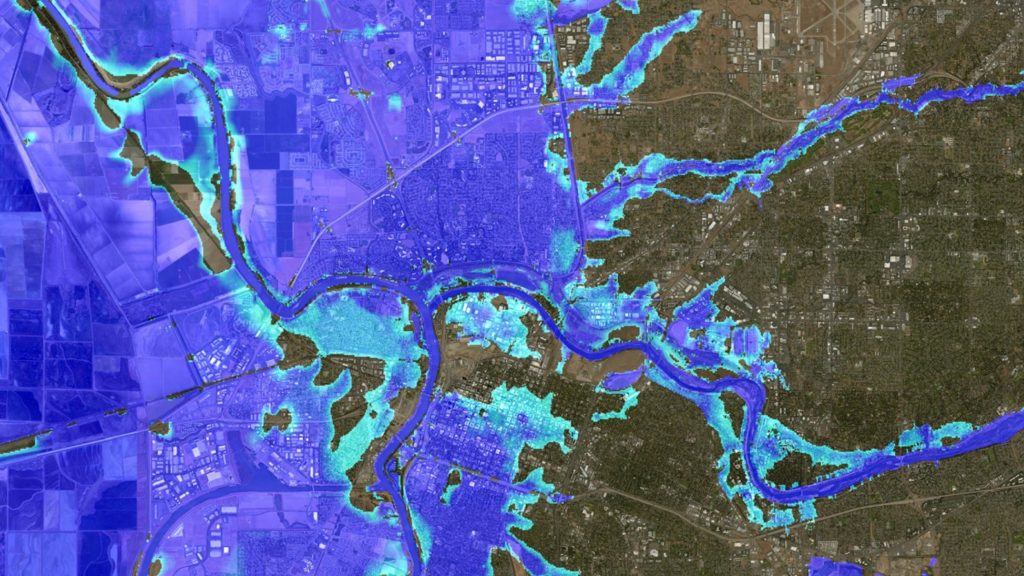

These “top-down” methods simulate flooding over continental–global scales simultaneously, taking advantages of new remotely-sensed data sources and fast computers. This contrasts to traditional “bottom-up” approaches, where engineers examine flood risk laboriously—river-by-river. Fathom research has shown the two approaches produce similar answers at local-scales, yet top-down models have the advantage of producing answers rapidly over wide areas—with no data gaps.

These tools – permitting re-simulation of future flood scenarios – will enable us to quantify the potential impacts of climate change, in turn enabling risk management communities to better understand the flood risks we presently face and those yet to come.