In this article we discuss the latest in emerging data, new research and its impact on our ability to simualte large scale flood risk.

What’s going on in the flood modelling industry at the moment of note?

There are some exciting things happing in the space of global flood modelling. Data sets are emerging that are significantly improving our ability to build models anywhere in the world.We’ve also recently published a paper demonstrating, for the first time, a method for developing realistic flood event footprints globally (paper link).

Looking forward, there are exciting signs that over the next few years we may see the emergence of a very-high accuracy global terrain dataset. This is what will revolutionise global flood modelling. Artic-DEM has produced high accuracy terrain models of the Arctic.And colleagues at Google have begun building flood models in India (blog link). This requires better terrain data and so efforts are being made to produce much higher accuracy terrain data, in developing regions, using methods that could be applied globally.

Why now for the launch of Fathom-Global 2.0, and what improvements have you made from the previous version Fathom-Global 1.0?

Since the release of Fathom-Global1.0 in 2016, we have seen and participated in the development of new input datasets, principally new terrain data and new hydrography data. We have also seen the development of new modelling methods to better represent the size of river channels (currently under peer-review) and excitingly methods to build global event-set and catastrophe models.

What makes Fathom-Global 2.0 different from what is already in the market?

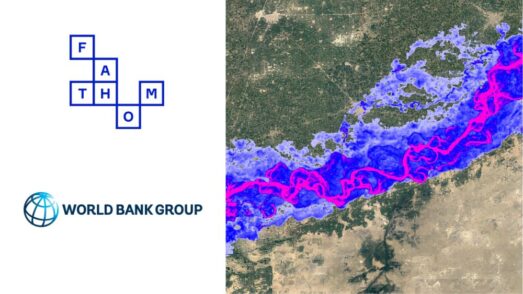

We have a much better representation of river channels, both in terms of where they are and how they behave in conveying water. We also have a significant improvement in our ability to simulate floodplains, owing to improvements in our terrain data. Finally, we can use this data to produce plausible event footprints and allow users to explore the impact of these events, anywhere in the world.

What does this mean for the insurance industry?

It means that we have far more confidence in our ability to simulate inland flooding, particularly in developing regions and emerging markets at a consistent scale globally. This means insurers can understand flood risk and exposure quickly and easily for any asset across the world. Importantly it also means that global flood Cat models are now becoming a reality and we are currently working our Partners to deliver this to the market.