Communities around the world and businesses across sectors are increasingly exposed to the risks posed by climate change. Extreme weather events such as floods and storms can affect business operations and disrupt supply chains and impact asset value and portfolio performance. Meanwhile, transition risks arise from policy shifts, technological advancements and evolving market expectations.

Contents

- What is climate risk?

- The two types: Physical vs. Transition risk

- Why climate risk matters for businesses

- Sector-specific impacts: Insurance, Finance, and Engineering

- What drives flood risk? (Climate vs. Human factors)

- How to measure risk: Flood maps vs. Catastrophe models

- The science of climate risk modeling

- Case studies and regulatory applications

What is climate risk?

Climate risk is the potential for climate change to have a negative impact on people, ecosystems, businesses and the wider economy.

Climate risk is very much a material risk. This means that the physical damage caused by climate change can have a major impact on the economy, on businesses and on the financial system. It’s why institutions and businesses across sectors are increasingly expected to incorporate climate-related risk into their risk management framework and to be more transparent in their climate risk disclosures.

Types of climate risk

There are two main forms of climate risk that businesses need to think about: physical and transition risk.

Physical climate risk

This is the risk of damage and disruption to people, property and productivity caused by climate-related hazards such as hurricanes and extreme flooding. The resulting financial losses include property damage, business interruption and higher insurance claims. Broader economic impacts can also arise from supply chain disruptions and diminished productivity.

Example: Increased flood risk impacting real-estate lending

A bank has a large mortgage portfolio concentrated in coastal areas and flood-prone regions. Because of climate change, the frequency and severity of extreme flooding events is rising, and this creates a material physical risk.

Property damage from floods can reduce the value of mortgaged assets, and borrowers affected by repeated flooding could face financial hardship and become more likely to default on their loan repayments.

Climate transition risk

This refers to the impact on businesses as a result of the shift towards a lower carbon economy.

Example: Stranded assets in the oil & gas sector

An asset management firm holds a large number of assets in the fossil fuel sector, such as oil rigs and pipelines. The rapid growth of clean energy technologies means these assets may become stranded, i.e. they lose value or become liabilities.

Because this could have a major effect on returns and portfolio valuations, it is considered material risk and must be assessed and disclosed.

Find out how Fathom’s climate-adjusted flood models and maps can help you assess, manage and report on climate risk.

Why climate risk matters

The need for businesses in all sectors to assess, manage and quantify climate risk is becoming more urgent as the climate evolves, extreme weather events become more severe and the exposure of people, property and infrastructure grows.

Traditional risk models that rely on historical data are no longer enough to address this need. Businesses need to adopt innovative approaches, including integrating climate-adjusted data into their risk frameworks.

This will not only help build resilience and sustainability into business models but it could also unlock the opportunities that climate risk presents. Development of innovative solutions, the opening up of new commercial opportunities and greater access to credit and capital are just some of the ways that institutions stand to gain a competitive edge from fully addressing climate risk.

The climate risk challenge for businesses

While businesses are aware of the urgency to prioritize climate risk, integrating it into risk management frameworks presents major challenges. Our recent survey of boards in the financial sector found:

- 93% of board members see climate risk as presenting ‘unique’ governance challenges

- 52% say that they would like more guidance on the most appropriate risk models to use for climate matters

- 81% state that accuracy and consistency of data is the greatest challenge that boards face with climate risk

Read our report, The climate challenge for boards: Perspectives from the financial sector, on attitudes towards climate risk among financial institutions.

Climate risk by sector

1) Insurance

Insured losses from natural catastrophes including flood have been on a consistent upward trend in recent years, and it’s expected that this will continue. The insurance sector faces ever-growing demands to quantify and assess climate risk, as well as increasing requirements for stress testing against an evolving climate. Impacts, both negative and positive, include:

- Increased claims from extreme weather events can put a strain on underwriting models and profitability and higher losses can raise capital and solvency concerns.

- The uncertainty inherent in climate change, particularly non-linear climate impacts (i.e. sudden, disproportionate and irreversible changes in the environment and in society) make it difficult to price future risk.

- Thanks to climate-adjusted data, risk assessments can be more granular and location-specific. This has enabled insurers to develop innovative solutions, such as parametric insurance and microinsurance.

Find out more about how Fathom works with insurers >

2) Financial markets

For financial sector businesses, climate risk affects everything from asset pricing to capital flows. Banks, fund managers, asset managers, capital markets and others face direct and indirect threats to financial stability, asset values and profitability.

- Lenders whose portfolios include climate-vulnerable sectors such as real estate, agriculture or energy may see more loan defaults.

- Increasing regulatory pressure to disclose climate risk and carry out climate stress testing increases the burden on compliance teams.

- Asset valuations can be affected by physical damage or regulatory shifts (e.g. stranded assets).

- Climate disclosure regulations are creating demand for climate risk services, ESG data platforms, and advisory services — areas that banks, insurers, and asset managers can monetize.

- The financial sector plays a pivotal role in capital allocation, so its ability to respond to climate risk will be crucial in driving a more resilient and sustainable global economy.

Find out more about how Fathom work with financial institutions >

3) Engineering and public sector

Engineering and planning teams, whether they are embedded in architecture, engineering and construction companies or in public sector organizations, play a critical role in managing, mitigating and adapting to the increasing risk of flooding and other climate-related hazards. Not only are they integral to safeguarding communities, property and infrastructure but they are also positioned to unlock new opportunities for innovation and funding. Impacts include:

- Extreme weather can halt construction, damage equipment and lead to delays and increased costs.

- Project designs may need adjusting to ensure climate resilience, which can drive up capital costs, while long-term exposure to physical hazards can increase maintenance and lifecycle costs.

- As requirements such as floodplain regulations become stricter, planning and approval processes can become longer and more complex.

- If not designed with future climate scenarios in mind, infrastructure may become obsolete, unsafe or uninsurable. Conversely, factoring in future climate risk can result in smarter, more resilient infrastructure design.

- Access to robust, climate-adjusted flood data can give engineering teams a competitive edge when submitting proposals or applying for governmental funding programs.

Find out more about how Fathom work with engineering firms >

What is driving future flood risk?

Climate change is not the only driver of future flood risk. Population growth, demographic shifts and changes in land use can also lead to rising levels of exposure and vulnerabilities.

Climate change

There is a 19th-century insight called the Clausius-Clapeyron equation, which tells us that for every 1 degree Celsius increase in temperature, the atmosphere can hold approximately 7% more moisture. That’s why a warming climate can lead to more intense and frequent rainfall and potentially more severe flooding.

- Globally, flood risk will increase 49% by the end of the century under the most pessimistic emissions scenario, according to this research by Fathom.

- In the US, Fathom’s scientists predict a 26.4% increase in flood risk by 2050 due to climate change.

Population changes and land use

While the changing climate is increasing the risk of flood, projected population changes far outweigh the impact of climate change. In fact, according to Fathom’s research, increased exposure due to population growth and urbanization have four times the impact of climate change.

- Population growth alone in a static climate (i.e. if there are no future changes in flood hazard) could result in a 72.6% increase in average annual exposure (AAE) by 2050.

- Population growth accounts for 74.7% of the increase in average annual exposure (AAE) to 2050, while climate change represents 19.1% of the change.

- In the US, the average annual exposure (AAE) to floods in 2050 is projected to increase by 97.3% from the present day.

Urbanization and development heighten flood risk by replacing natural, permeable landscapes with impermeable surfaces such as roads, pavements, and buildings. This reduces the ground’s ability to absorb rainfall, leading to greater surface runoff that can quickly overwhelm drainage systems and cause pluvial (flash) flooding in densely built areas.

Urban expansion also often alters or removes natural flood defenses like wetlands, river channels, and floodplains, diminishing the landscape’s capacity to store excess water.

Poor planning can also lead to higher exposure to flood risk. Building homes and infrastructure in low-lying or flood-prone areas such as river valleys or reclaimed wetlands puts more people and infrastructure in harm’s way.

Read Fathom’s research paper on the human factors affecting flood risk: Inequitable patterns of US flood risk in the Anthropocene.

Climate change and flooding

Hurricanes Helene and Milton: The impacts of extreme weather

In September 2024 Hurricane Helene made landfall in Florida’s Big Bend region in the US. It was the strongest hurricane on record to strike the region and led to 250 fatalities and tens of billions in economic costs. It was followed two weeks later by Hurricane Milton, which formed in the south-west Gulf of Mexico.

Helene’s most severe impacts were from the historic rainfall (up to over 30 inches) and record-breaking flooding across much of western North Carolina – far from where the hurricane made landfall.

Both Milton and Helene were characterized by their extremely rapid intensification, fueled in part by record-breaking sea surface temperatures. While it is difficult to determine the precise role climate change played, early attribution studies suggested that the observed rainfall was estimated to be up to 20 times more likely in these areas because of global warming.

Both events brought into sharp focus how climate change is impacting flood risk in the US. And it showed how catastrophic events can impact areas that are not necessarily prepared for them.

Find out more about what happened and what we can learn about evolving climate risk in the US in our insight.

How to measure climate-related flood risk: Maps vs models

Tools for measuring climate-related flood risk range from global climate models to highly localized flood mapping and risk assessment platforms.

Fathom’s flood maps and models are underpinned by best-in-class terrain data and incorporate our Climate Dynamics framework. They help insurers, financial institutions, engineers and other risk professionals to understand their flood risk in both present and future climate scenarios.

But what is the difference between a map and a model, and which should your business be using? Let’s take a deeper dive:

Flood maps: Identify flood risk and exposure

Put simply, a flood map is a static map that shows you where floods could occur, their severity (e.g. a 1-in-100-year flood), and their potential extent and depth.

This “where and how deep” snapshot helps risk professionals identify where to build and invest. It supports infrastructure planning and aids resilience and adaptation strategies.

Flood maps are used to:

- Identify flood-prone areas: Pinpoint locations at risk from river (fluvial), surface (pluvial), and coastal flooding.

- Assess flood risk exposure: Evaluate which assets, properties and populations are exposed to flood hazards under various scenarios (e.g. different warming scenarios and flood return periods such as 1-in-100-year).

- Support decision-making: Inform insurance underwriting, pricing, infrastructure planning and disaster preparedness.

- Ensure regulatory and ESG compliance: Demonstrate proactive risk management and sustainability practices.

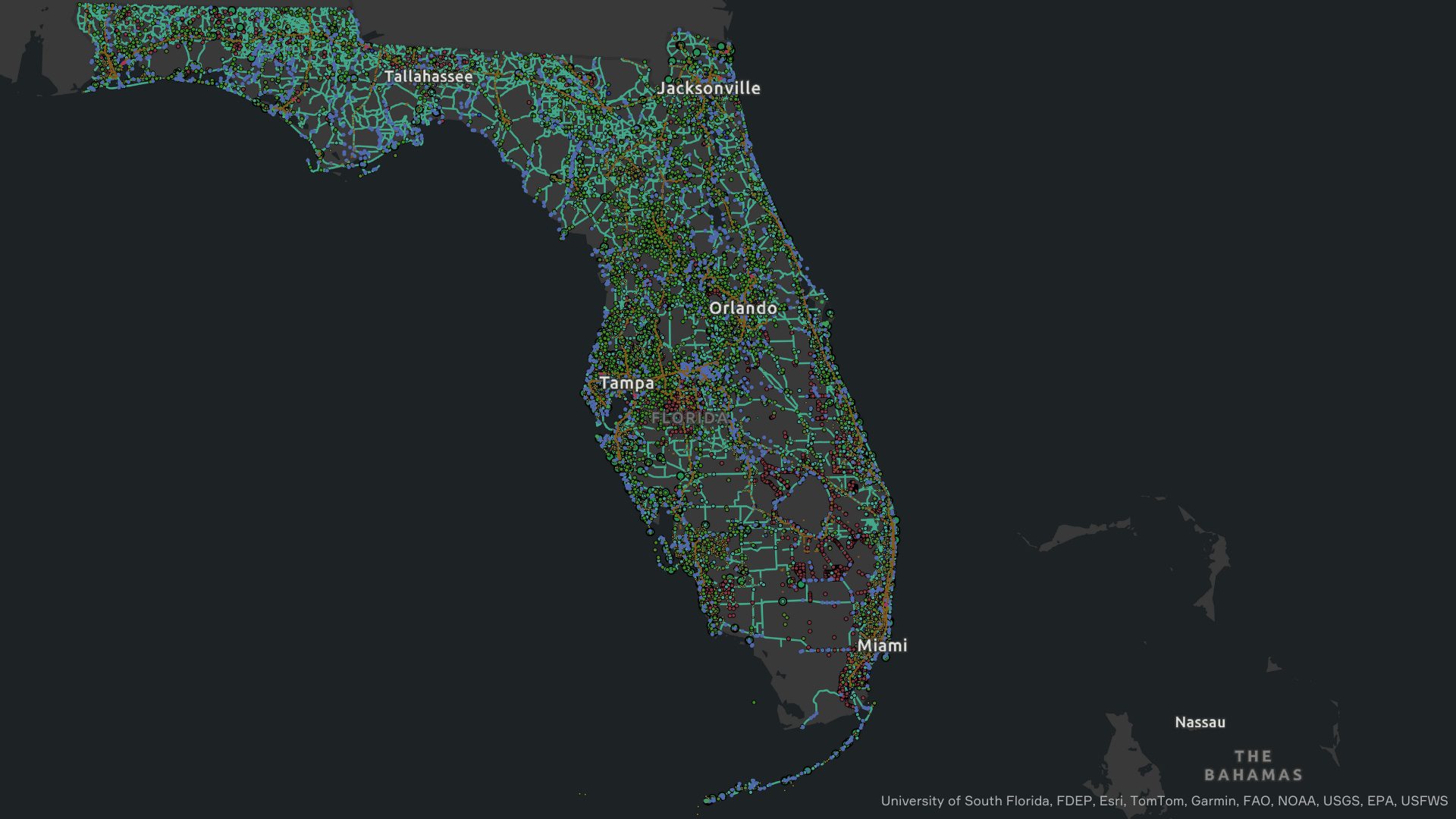

Fathom’s Global Flood Map

Fathom’s Global Flood map can be customized to represent a variety of return periods, time horizons, emission pathways and climate scenarios so that you can explore all possible futures. It is the first global flood map to provide risk professionals with all perils and climate options.

Find out how our Global Flood Map revolutionizes how we represent the impact of climate on flood risk. Discover Fathom’s Global Flood Map >

Catastrophe models: putting a price on flood risk

While flood maps tell you ‘where and how deep’ a flood will be, catastrophe (cat) models tell you how much it will cost. That’s the most basic explanation, of course. Cat models are very sophisticated probabilistic models that simulate thousands, or even millions, of high-impact natural catastrophe events, allowing risk professionals to estimate potential losses caused by damage to buildings, infrastructure or insured assets.

Cat models are used in:

- Insurance pricing and underwriting: to set premiums, policy terms and portfolio risk based on exposure to catastrophic events.

- Capital management and reinsurance: To inform decisions on how much capital to hold or how to structure reinsurance to remain solvent after a major event.

- Regulatory requirements: To meet risk disclosure rules and provide evidence of sustainable risk management practices.

Fathom’s Global Flood Cat

Fathom has integrated future climate scenarios into its Global Flood Cat, making it the first flood cat model to include them at a global scale.

It allows users to represent financial losses for any plausible climate scenario and enables you to simulate flood risk across all major perils – fluvial, pluvial and coastal.

The framework also supports custom views of vulnerability, event loss scaling, hazard scaling and location-specific flood defenses.

Discover Global Flood Cat Future, our comprehensive tool for understanding current and future risk.

Climate risk modeling

Climate risk modeling is all about being able to model risk in various future scenarios. This enables businesses to assess and quantify future flood risk and make better informed decisions around mitigation, resilience planning and adaptation.

The challenges of modeling climate risk

To show how flood risk changes over time, models need to consider multiple emissions and climate scenarios and need to deliver on both a global and country-by-country basis.

To do this we need to apply climate model output to flood models, which is one of the biggest challenges. Climate model data tends not to be of high-enough resolution to drive flood models and they inevitably involve high levels of uncertainty.

The change factor solution

Most approaches have used an application technique to chart the output of one or more climate models onto an existing flood model. These techniques include regional modeling, which nests a higher-resolution climate model covering a smaller domain within a coarser-resolution global climate model, or bias correction using observational data.

Fathom’s scientists, however, address the problem by using the change factor approach.

Change factors offer a practical way to translate coarse-scale climate projections into local-scale inputs for flood modeling. This allows us to explore how climate change could affect flood frequency and intensity without relying entirely on complex, downscaled climate simulations.

Want to go deeper into the science behind climate models for global flooding? Read our insight, Modeling the impact of climate change on global flooding.

Fathom’s Climate Dynamics

Climate Dynamics is a flexible framework integrated into Fathom’s flood maps to model the impact of climate change on global flooding. It addresses the challenge of representing future risk through climate model and flood hazard data, by modeling the impacts of climate change within a range of plausible future scenarios. The solution offers a way to apply geographical granularity on a global scale.

Users can tailor their view of risk, customizing time horizons, climate scenarios and warming levels within any plausible combination. The Fathom team has clearly accounted for climate model uncertainty, providing the median and likely range of outcomes based on IPCC definitions.

This means the framework is fully transparent, enabling users to understand the underlying modeling assumptions and form their own assessment of risk.

Want to find out more about Climate Dynamics, the science behind it and how we made it? Watch the webinar, The making of Fathom’s Climate Dynamics framework or view our dedicated Climate Dynamics page.

Climate risk management and assessment: integrating flood risk tools

Every business sector is impacted by climate risk. The disruption and damage caused by climate-related events such as flood and wildfire can impact individual businesses, the financial system and the wider economy. It can affect supply and demand, disrupt operations, devalue assets – the list goes on.

That’s why institutions have a responsibility to assess the risk fully and manage it accordingly to protect stakeholders and shareholders, customers, infrastructure, communities and livelihoods.

Whether you’re an engineer conducting site feasibility for a critical infrastructure project or an asset manager meeting due diligence requirements, climate risk can no longer be ignored.

Fathom’s climate-conditioned, global flood data, maps and models are used by leading financial institutions, banks, engineers, corporates, international development bodies and insurers to understand and manage climate risk both now and in the future.

Engineering, land use and urban planning

Fathom works with architecture, engineering and construction (AEC) companies, asset owners, GIS specialists and public sector organizations who need to integrate climate risk into planning, risk assessments and long-term resilience.

Fathom provides rapid access to flood risk data that helps organizations identify and mitigate both present and future flood risk.

Infrastructure planning and site selection

- Use case: Engineering firms integrate Fathom’s data with GIS tools to screen and rank potential project sites by flood risk.

- Example: A consultancy designing a new hospital campus uses Fathom’s UK Flood Map to avoid high-risk flood zones and inform elevated building design.

Flood resilience design

- Use case: Inform design specs such as base elevation, drainage capacity, and flood defenses.

- Example: Engineers use Fathom’s high-resolution maps to model future fluvial flood extents and determine the minimum elevation for a transport terminal in a floodplain.

Climate adaptation and urban planning

- Use case: Planners use Fathom’s future scenarios to model urban resilience under projected sea level rise and rainfall extremes.

- Example: A US state authority uses Fathom data to identify critical infrastructure (e.g., water treatment plants) at risk of future flooding and prioritize adaptation investments.

Want to find out more about how Fathom’s data fits into engineering, planning and risk management processes? Learn more about Fathom solutions for engineers >

Fathom and public sector resilience planning

Fathom works extensively with public sector bodies, supporting regional and national flood assessment and resilience planning initiatives.

Read about how Fathom worked with a local engineering company and the Florida Department of Environmental Protection (FDEP) on a statewide flood vulnerability assessment.

The insurance sector

Floods are becoming more frequent and severe and are happening in places that have not seen significant flooding before. These changes are driven by both urbanization and climate change.

Insured losses from natural catastrophes, including flood, have been on a consistent upward trend in recent years, with projections suggesting that this trend will continue. That’s why it’s increasingly important for insurers to understand the risk posed by flooding, and the impacts of climate change must be incorporated into pricing, reserving and capital modeling.

Flood modeling for insurers

Insurers use both flood hazard maps and catastrophe (cat) models to assess and manage flood risk. Cat models simulate hundreds of thousands to millions of plausible events representing a synthetic period of time (e.g. 10,000 years). Crucially, the spatial correlation (i.e. if one location floods in an event, will another location) is captured, which is key when assessing a firm’s capital and reinsurance requirements.

Insurers have been using cat models for 30 years, but a global, climate-conditioned flood catastrophe model with a thorough representation of damage uncertainty which can handle a wide range of emission scenarios and accounts for all major flood perils (pluvial, fluvial and coastal) did not exist, until Fathom’s Global Flood Cat, incorporating our Climate Dynamics framework, was released.

Fathom’s Global Flood Cat allows insurers to quantify risk under any climate state, including global warming levels up to 5°C, under a wide range of emissions pathways and any time horizon to 2100. This provides a climate-driven view of both present and future risk.

Three ways Fathom’s products help insurers:

- Underwriting: Our flood maps and Risk Scores help inform better decisions about which risks to accept. They allow insurers to understand existing exposure and develop a unique view of flood risk, on an individual property or multi-location level.

- Pricing: They help pricing teams make informed decisions and develop data driven pricing strategies that not only ensure regulatory compliance but also align seamlessly with overarching business objectives.

- Regulatory use/stress testing: Fathom’s Climate Dynamics framework allows you to understand flood risk for a wide range of potential future climate states, time horizons and emission pathway scenarios. This enables you to confidently respond to regulatory requirements and conduct thorough stress tests.

Find out more about Fathom’s work with the insurance sector >

The financial markets sector

Increased regulation and external demand for transparency mean that climate risk is a hot topic across the financial sector. Integrating high-quality climate risk data into due diligence, portfolio screening and valuation processes has become imperative.

Fathom uses an ensemble of climate models to help quantify the uncertainties around climate change, allowing users to apply their view of the future to determine climate-change flood-impact on a portfolio.

Fathom’s global flood data, maps and models provide a physically consistent view of flood risk for short-, medium- and long-term time horizons, any year or period up to the year 2100, with our Climate Dynamics framework. And you can customize the data to fit country-specific regulatory needs.

The role of actuaries

Climate-focused actuarial roles are on the rise. Find out how actuaries use flood modeling to navigate climate risk in our special report, Navigating global flood hazard and catastrophe modeling in a non-stationary world – A primer for actuaries.

The financial markets sector

Increased regulation and external demand for transparency mean that climate risk is a hot topic across the financial sector. Integrating high-quality climate risk data into due diligence, portfolio screening and valuation processes has become imperative.

Fathom uses an ensemble of climate models to help quantify the uncertainties around climate change, allowing users to apply their view of the future to determine climate-change flood-impact on a portfolio.

Fathom’s global flood data, maps and models provide a physically consistent view of flood risk for short-, medium- and long-term time horizons, any year or period up to the year 2100, with our Climate Dynamics framework. And you can customize the data to fit country-specific regulatory needs.

This helps businesses across the financial sector to understand portfolio risk, accurately price assets, undertake pre-investment due diligence and respond to regulatory frameworks.

Fathom helps financial institutions with:

Accurate pricing of assets

Have a clear understanding of climate-induced flood risk, the likelihood of floods occurring in a given area and the costs associated with managing such events.

Understanding portfolio risk:

Take a holistic view of exposure by considering all the assets in your portfolio and assessing both direct (asset-level) and indirect (outlying) flood.

Regulatory/stress testing:

Answer any question and conduct all necessary flood risk portfolio analysis using Fathom’s flexible Climate Dynamics framework. Customize the data to fit your regulatory needs, or use one of our recommended options, designed to meet regulator requirements.

Pre-investment due diligence:

Understand the potential impacts of climate-induced floods on specific assets. Identify any areas that may be particularly vulnerable and design strategies to reduce exposure.

Climate risk and banks

Climate risk significantly impacts banks. The risk is both transitional and physical, affecting their own operations and increasing their credit risk thanks to a higher likelihood of defaults from borrowers affected by climate-related events. According to S&P, many of their largest clients have assets that are highly vulnerable to climate change.

Almost 60% of companies in the S&P 500 and more than 40% of companies in the S&P Global 1200 hold assets at high risk of physical climate change impacts. These companies are many of banks’ biggest clients.

Increasingly, regulators such as the Bank of England and ECB are conducting climate stress tests on banks, and pushing them to identify, manage, and disclose their climate risks to maintain financial stability. But, despite 56% of chief risk officers recognizing climate risk as the top emerging threat, it has historically been underestimated.

This is largely because calculations are too often based on current or recent weather patterns. Banks urgently need access to reliable, high-quality data that considers future climate scenarios. This is key to stress testing and scenario analyses and for fully understanding and mitigating their climate risk. Ultimately, this will help ensure resilience in a changing world.

Learn more about the role of data in climate risk and banking in our insight: Climate risk in banking: A growing threat and untapped opportunity

In 2021, Fathom supported the Bank of England with its Climate Biennial Exploratory Scenarios (CBES) 2022, an exercise that explored the impacts of the physical and transition risks of climate change. Find out how Fathom’s data was used to produce a comparative benchmark for the Bank’s analysis of flood risk returns.

Why work with Fathom

Measuring climate risk is increasingly important for businesses in every sector, as regulatory pressure grows and climate-related physical risk increases.

Fathom works with some of the world’s leading organizations in the financial, insurance and engineering sectors to manage and quantify their climate risk. Because our global flood models and maps have climate data built in, these businesses are able to understand and prepare for the risks they face – both now and in the future.

Want to know how Fathom our businesses and organizations are using our flood data to assess, quantify and manage their climate risk? Discover Fathom’s Global Flood Map