Video 30.07.2021

Intro

In June this year the Prudential Regulation Authority, part of the Bank of England, released its requirements for banks and insurers to explain their future exposure to climate change risk.

This event was hosted by Instech and joined by Fathom and Nasdaq talking about some of the practical steps insurers can take to assess the risk. Expect the usual lively discussion, deep learning and audience participation.

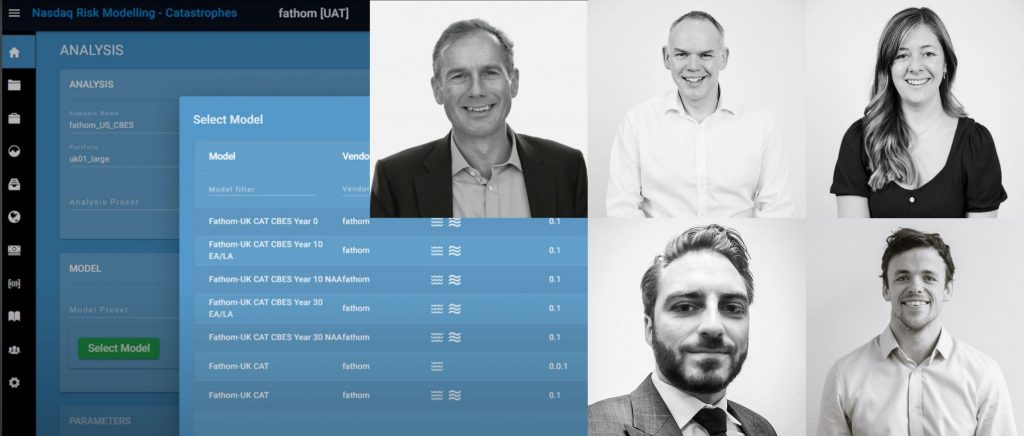

The panel for this event includes:

Matthew Grant, Partner, Instech

Dr Tom Philp, Chief Executive Officer, Maximum Information

Dr Matthew Jones, Head of Catastrophe Risk Products, Nasdaq

Dr Andrew Smith, Chief Operations Officer, Fathom

Dr Natalie Lord, Senior Climate Change Expert, Fathom

In this interview, we spoke with Nasdaq to discuss how our latest climate conditioned model can support insurers to stress test against climate related flood risk.

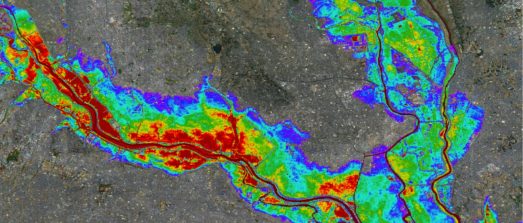

How can Fathom support your business with climate-related physical risk?

Fathom have produced a range of climate-conditioned models, using the latest available climate data. To learn more about how this can support you to understand the impact of a flood on your portfolios, get in touch.