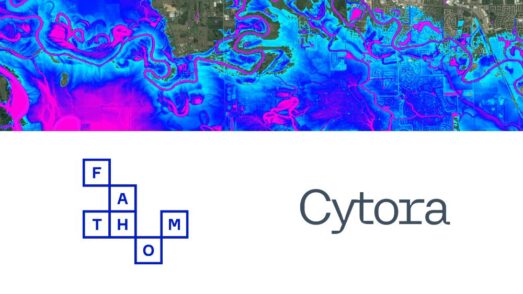

2024 update: Fathom’s US Flood Map now available in CatNetⓇ

- Swiss Re acquires Fathom, a UK-based company specializing in water-related risks under current and future climate scenarios

- Fathom’s expertise complements Swiss Re’s capabilities in the field of data modeling and risk transfer for flood perils

- The Fathom team will work closely with Swiss Re’s Reinsurance Solutions division to provide innovative tools that help improve society’s resilience against floods

Zurich, 13 December 2023 – Swiss Re announced today that it has acquired Fathom, a leading provider of water risk intelligence and flood models, based in Bristol, UK. Through this transaction, Swiss Re’s Reinsurance Solutions division gains valuable expertise and a robust set of products, complementing its own data and risk capabilities in the field of flood perils – a major driver for constantly rising losses from natural catastrophes globally.

Russell Higginbotham, CEO of Swiss Re Reinsurance Solutions, said:

“We are very pleased to join forces with Fathom in our quest to narrow the protection gap for natural catastrophe risks, such as floods. Fathom’s market-leading research and innovative tools in this area create great synergies with Swiss Re’s risk knowledge and digital capabilities. I’m thrilled to welcome the Fathom team to the Swiss Re organisation and look forward to a successful collaboration.”

Stuart Whitfield, CEO of Fathom, said:

“We are committed to helping organisations around the world to analyse, understand and respond to flood risk and the changing climate landscape. Thanks to the strong alignment between our ethos and approach, I’m excited to see us work together with Swiss Re Reinsurance Solutions to bring our sophisticated risk insights to even more customers and help deliver greater global resiliency. This transaction represents a further key step in helping us achieve our vision of becoming the gold standard in the provision of water risk intelligence.”

According to latest Swiss Re data, the re/insurance industry covered roughly 40% of the economic losses related to natural catastrophes in 2023, indicating a large protection gap across the world. Swiss Re estimates that, globally, natural catastrophes caused USD 100 billion insured losses this year alone. At least USD 12 billion of these total insured losses can be attributed to flood-related events, which is more than 30% higher than the past ten years’ annual average.

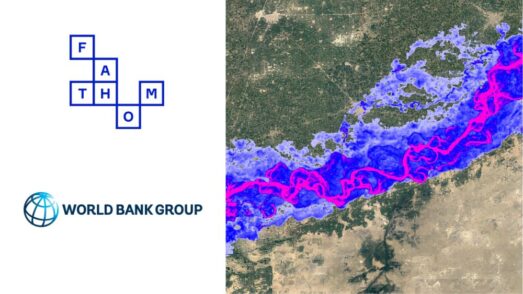

Advanced data modeling, combined with scientifically robust tools and intelligence, enable insurance and risk management professionals to better understand the impact of floods on people, buildings, and businesses. Fathom is dedicated to leveraging its expertise in this field to help its customers efficiently identify, analyze and mitigate flood risks. By working closely with Swiss Re Reinsurance Solutions, Fathom gains access to Swiss Re’s client franchise and long-standing expertise in the field of natural catastrophes.

As part of this transaction, Fathom will retain its own brand and continue its well-established research activities.

From the outset, our organizations recognized the cultural and technical alignment between Swiss Re and Fathom, and therefore are excited about this opportunity. By working together, we can enhance access to our existing products and services while also accelerating our ambitious roadmap to develop and distribute world-leading solutions to improve risk resilience against water perils, without compromising on our mission and values.

Fathom will retain our brand and remain a research-led organization developing and delivering best-in-class modeling solutions. Its team will remain the same.

We chose to partner with Swiss Re and their Reinsurance Solutions division because of their unrivaled reputation in the reinsurance space, global reach and science / research-led culture. We had been discussing a number of commercial collaboration projects to enable the development of high-resolution data and scale up risk modeling for data-scarce regions, and so this seemed the logical next step.

Fathom continues to work with Moody’s RMS on the distribution of Fathom’s models via their Intelligent Risk Platform. You can learn more about this work here. Moody’s is no longer a Fathom shareholder.

This partnership is a signal to all of our clients that we’re here to stay. Our existing, industry-leading portfolio of products and services will not be shrinking, and we’re looking forward to enhancing future solutions with Swiss Re’s knowledge, experience and data.

In short, no.

By accessing Fathom’s technical expertise and best-in-class model solutions, Swiss Re will be able to expand and refine its offering, helping clients make data-driven business decisions with confidence.

These partnerships are unaffected and we look forward to continuing to grow those relationships.

All of our existing contracts are still valid, and invoices will continue to be dealt with in the same manner.

If you have an existing relationship with our business development team, please do not hesitate to reach out to them directly. Alternatively, you can use the contact form below, and a member of the Fathom team will be in touch. If you are a member of the media, our PR Manager Jessica Roberts can be reached at j.roberts@fathom.global.