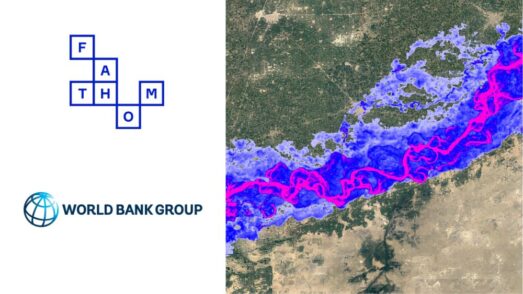

Fathom have launched their updated U.S. Flood Model, Fathom-US, via ModEx®, the multi-vendor catastrophe modelling platform for the insurance industry.

Fathom release extensive flood model via Modex

Fathom have launched their updated U.S. Flood Model, Fathom-US, via ModEx®, the multi-vendor catastrophe modelling platform for the insurance industry. Fathom-US utilises award-winning science with the methodology behind the model having been subject to global academic peer review. The Fathom-US flood model has also been validated, in collaboration with Google, across the entire conterminous United States, providing users with transparency around the methods and model performance.

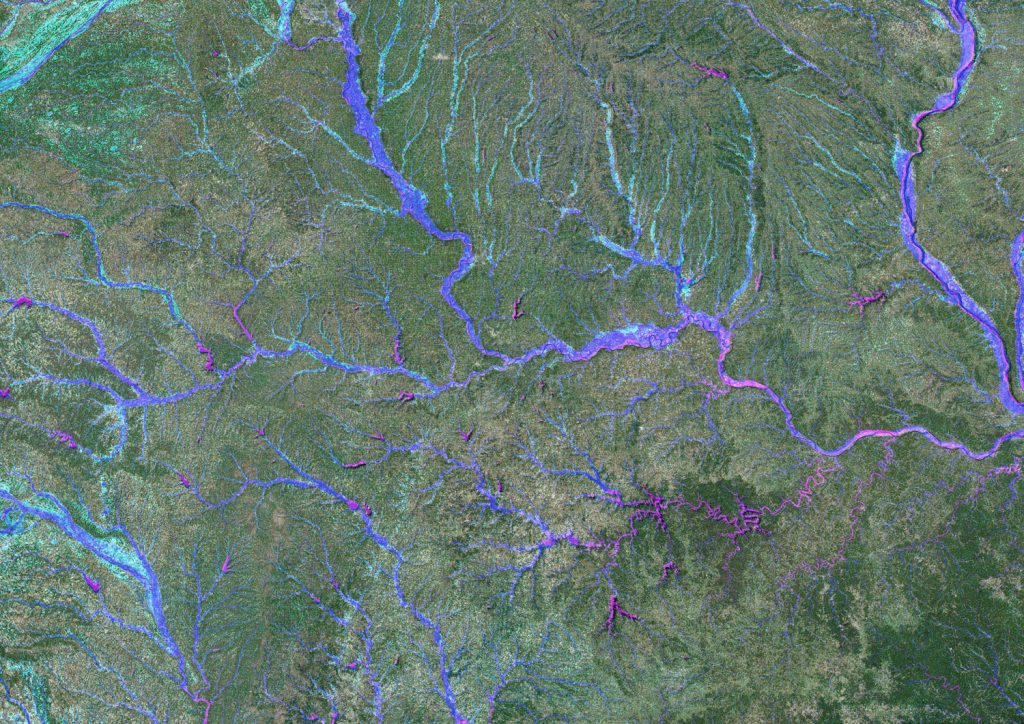

Fathom’s unique modelling techniques incorporate the latest datasets available from the US Geological Survey, NASA, Microsoft and the US Army Corps to model flood risk across river channels of all sizes, and for both fluvial and pluvial perils. Fathom-US provides a complementary solution for organisations who do not wish to depend solely on their incumbent flood model and desire an alternative view of risk.

Formed in 2013 out of the UK’s University of Bristol Hydrology Research Group, a world leading authority in modelling flood risk. Fathom operate on the principle that academic scrutiny is fundamental to producing the best flood data available. Their mission is to create the most detailed, accurate and comprehensive flood intelligence data covering the entire planet. Through their flood hazard data and models, they aim to transform risk assessment, climate change planning decisions, disaster response and emergency preparedness.

By making the model available via ModEx, Fathom provide a cost-effective solution for organisations who have neither the budget nor in-house resources to implement multiple models by themselves. Powered by the Oasis LMF, ModEx delivers a hosted and fully managed service that offers a new and cost-effective way for firms to meet their modelling requirements.

Dr Andrew Smith, COO, Fathom, comments:

“Fathom is dedicated to providing the most-detailed understanding of flood risk across the globe. Accuracy is vital. Our recent research has revealed 40 million Americans are at risk of having their homes flooded – more than three times as many people as previous federal flood maps suggested. As interest in US flood risk modelling continues to grow, ModEx provides us with the ability to improve access to our data and models.”

James Lay, Commercial Director, ModEx:

“Fathom’s unique approach to flood risk modelling will further enhance the industry’s understanding of risk and provides greater insight to those tasked with preparing and managing against such floods.By making their models more broadly available through ModEx, we further extend the choice of cat modelling services that are available to the industry.”

ModEx, now a part of Nasdaq, provides a dynamic catastrophe modelling ecosystem for the (re)insurance industry, uniting multiple catastrophe models, hazard maps and data enhancement services through one platform.

For further information, please contact:

Anna Hallgren

+46 733 478720

anna.hallgren@cinnober.com

ABOUT MODEX®

ModEx, now a part of Nasdaq, is the multi-vendor catastrophe risk modelling platform for the (re)insurance industry. Powered by the Oasis LMF, ModEx delivers a hosted and fully managed catastrophe risk modelling service that offers a new and cost-effective way for firms to meet their modelling requirements. The platform creates an ecosystem where model vendors make their models available to the industry via a single user interface, improving the quality and choice of models available in the market. For further information, please visit the ModEx site.