Proof of concept for new Intelligent Risk Platform modeling engines integrating third party data, including Nasdaq’s Risk Modeling for Catastrophes, demonstrated using Fathom’s US flood catastrophe model

Moody’s RMS, the leading global catastrophe risk modeling and solutions company, has shown for the first time the integration of third party risk models through its Intelligent Risk Platform™ using Fathom’s US flood model.

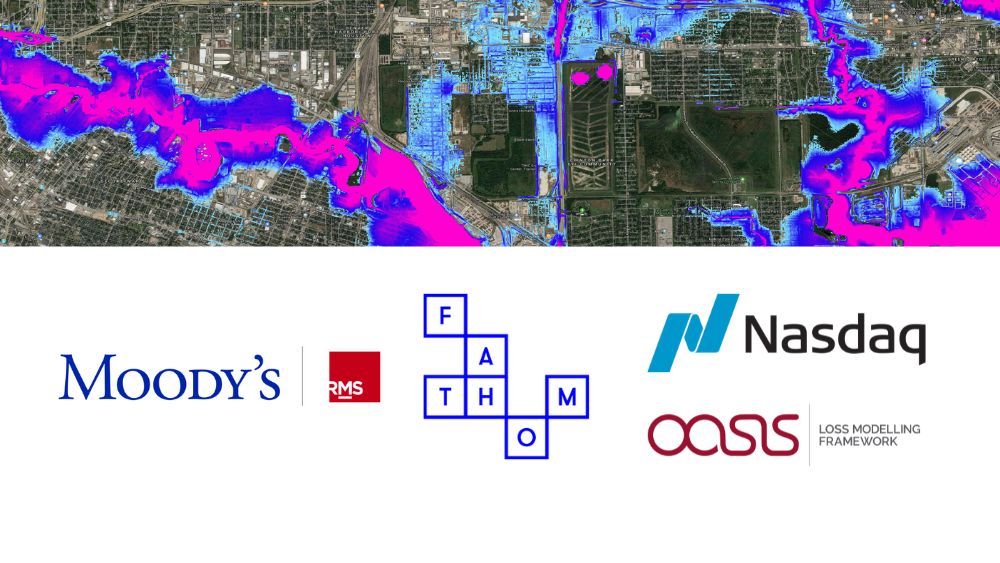

The proof of concept demonstrates the integration of data from third party vendors that will enable users of Intelligent Risk Platform to combine Nasdaq’s 300+ risk models with Moody’s RMS’s portfolio of 400+ models.

This unified modeling approach represents a significant milestone for efficient model availability in risk analytics. It heralds an open platform approach allowing users to view risk across multiple models from different vendors.

Access to this combined, richer portfolio of best in class models is delivered by the introduction of two new modeling engines in the Intelligent Risk Platform:

- A new Moody’s RMS open modeling engine designed to integrate with external modeling platforms, such as Nasdaq Risk Modelling for Catastrophes (NRMC), allowing direct connection to the Intelligent Risk Platform for seamless execution of third-party risk models available in the Nasdaq environment alongside Moody’s RMS risk models. The feasibility of this approach was evidenced using Fathom data hosted in the NRMC platform.

- A new, fully integrated Moody’s RMS native modeling engine designed to allow integrated custom models, including 3rd party models such as Fathom’s US flood catastrophe model and RMS’ customers’ home-grown models, to be executed within the Intelligent Risk Platform. The native modeling engine can directly utilize selected model execution capabilities and data formats within the Intelligent Risk Platform to build risk models that may not be possible to construct with other modeling frameworks.

The preview today at Moody’s RMS’ annual Exceedance conference in New York City used the company’s cloud-native catastrophe modeling application Risk Modeler to run Fathom’s US flood catastrophe model on Intelligent Risk Platform, both natively and via Nasdaq’s NRMC. This integration incorporates data conversion, including between Moody’s RMS’ Exposure Data Module (EDM) and Open Exposure Data (OED) formats, removing a significant barrier to multiple model usage.

With the merged offering, customers will be able to use applications such as Risk Modeler, UnderwriteIQ and TreatyIQ for unified execution of RMS models alongside third-party models, and for consolidated access to third-party models running on the Nasdaq modeling service, which is based on the Oasis Loss Modeling Framework.

As the Intelligent Risk Platform evolves, more Fathom and third party vendor models are planned to become available through the platform. To learn more about third-party modeling on the Moody’s RMS Intelligent Risk Platform, read their announcement.

Dr Andrew Smith, Co-Founder and Chief Operations Officer, Fathom, said:

“We welcome the ecosystem innovation that Moody’s RMS, working with Nasdaq, is bringing to the risk market. We believe it will be incredibly attractive for customers to access multiple views of risk through the same interface, and are proud to see the role Fathom’s data has played in validating the feasibility of the new platform. By standardizing and simplifying multi-vendor exposure and results data, it will offer greater flexibility and efficiency for risk professionals. As we look to the future, we are excited to explore how more of our hazard risk data can be shared through the platform – watch this space.”

Cihan Biyikoglu, Executive Vice President, Moody’s RMS, said:

“We are very excited about Nasdaq’s commitment to work exclusively with RMS to develop unified risk modelling in addition to facilitating integration of customers’ own models. The science and technology to make every risk known is continually evolving. At the genesis of the Intelligent Risk Platform, our intent was to unify risk analytics. Unified risk modeling with the new architecture is a critical step forward in that direction. The upcoming unified modeling capabilities within the Intelligent Risk Platform will not only simplify the great infrastructural complexity of data format conversion and enable many more customers to have access to multiple views of risk, but I believe will also accelerate industry innovation in the risk analytics space.

“Our customers expect Moody’s RMS to provide best in-class modeling incorporating the latest science and technology. By opening the Intelligent Risk Platform to include third-party models, companies will be able to blend and group Moody’s RMS, Oasis, or their own risk models to better enable unified views of risk, improve modeling efficiency, and gain a unified modeling approach across all insights, systems, and solutions.”

James Lay, Senior Director, Nasdaq, said:

“The market is increasingly utilizing catastrophe models from multiple vendors to inform risk selection, risk pricing, and portfolio management decision-making. We believe that greater integration between the Nasdaq Risk Modelling for Catastrophes platform and the Intelligent Risk Platform will deliver enhanced benefits and efficiencies for our clients, and the reinsurance marketplace, while maintaining the independence of Nasdaq in the market. With this integration, Nasdaq customers will benefit from simpler access to modeling using the Moody’s RMS Intelligent Risk Platform data schema and data conversion functions that accept both Open Exposure Data (OED) and Exposure Data Module (EDM) formats and then simplify risk transfer using Results Data Module (RDM).”

Dickie Whitaker, Chief Executive, Oasis Loss Modelling Framework, said:

“Oasis was established to increase choice in catastrophe modeling; it also has a key role to curate and promote standards. It is clear that this move will help both of those goals. The Nasdaq agreement helps create a trusted environment and independence for all model providers, as well as protecting individual model intellectual property. Equally, because Moody’s RMS is using standards encompassed by Oasis open-source software, this will help support the functions that Oasis exists to perform.”

Fathom’s US flood catastrophe model forms just one part of its extensive product portfolio, which includes a Global Flood Map offering providing users with climate conditioned flood hazard data for any projected combination of future year and climate scenario up to 2100, and its Global Flood Catastrophe Model. Fathom has also partnered with tropical cyclone experts Reask to bring new hazard data maps and catastrophe risk models to market, which cover the combined perils of flood and wind.

For any media or press enquiries please contact Jessica Roberts at j.roberts@fathom.global.

For more information, check out Cihan Biyikoglu’s blog on the Moody’s RMS website.