In the third episode of our Fathom Insights series, Dr Chris Sampson and Dr Niall Quinn outline the methods and data underpinning the updates to our revolutionary Fathom-US hazard model.

Discover the latest in US flood mapping

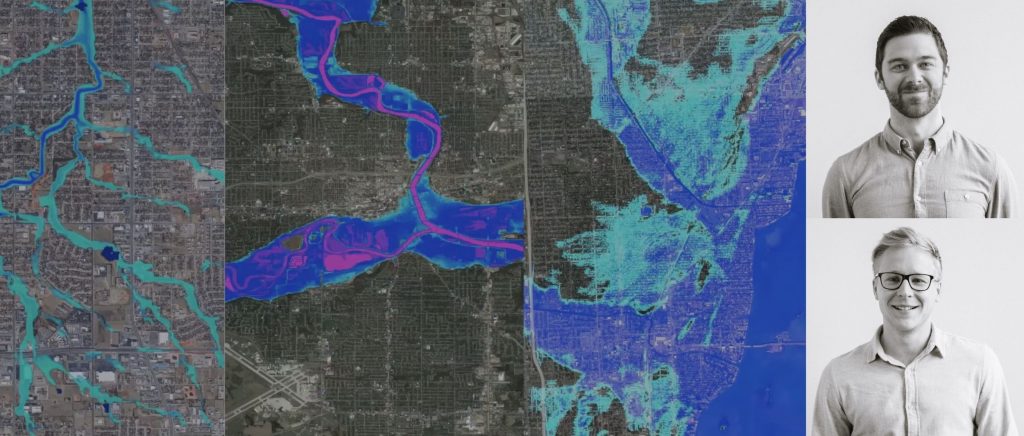

A new US Flood Map for 2023, discover Fathom’s new US model. The most complete and technologically advanced flood map

for the United States.

Flooding is the most common and costly natural disaster in the US, but uptake of private flood insurance across the country still remains low and existing FEMA flood maps are often outdated and lack consistency.

Catastrophic flood events are likely to increase in severity and frequency as sea levels rise, significantly escalating economic losses for the (Re)insurance industry. Fathom-US 2.0 now enables insurers to accurately analyse and communicate risk, countering previous underestimation of flood exposure and inappropriate rating, boosting flood insurance penetration and improving underwriting profitability.

In a first for a national scale US flood model, Fathom-US 2.0 is adapted to account for climate change rather than relying solely on historic records. It has been uniquely developed to provide a current climate change scenario for 2020 as well as a 2050 future climate state and uses synthetic hurricane data to forecast changing hurricane behaviour.