In recent years attempts to curb global warming have placed significant emphasis on the economic implications and risks associated with decarbonization – often at the expense of discussing the practical steps that need to be taken to mitigate the very real impact of climate change itself. Consequently, physical risks have largely been unaccounted for, rendering climate-risk data of limited value for investors, asset managers and lenders.

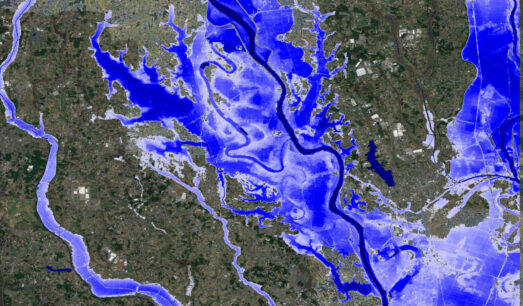

Fast forward to today when the impact of climate change is becoming more severe. Its effects are most visible in the form of sudden, devastating extreme events like flooding, that lead to immediate loss of life, resources and infrastructure. However, they are further compounded by the gradual deterioration of vital resources like soil quality, a slow but continuous decline that, if left unaddressed, can transform once thriving farms and communities into uninhabitable spaces.

As risk managers seek to make informed decisions and avoid potentially unexpected losses, the need for high-resolution, complete and globally consistent climate-risk datasets is rising, with investment and lending sectors seeing unprecedented demand for data.

This demand is driving the growth of a largely unregulated global climate risk data industry where global advisory firms, banks and established data providers compete with start-up businesses. Barriers to entry are low, and data governance standards vary, giving rise to questions around data quality and greenwashing. For risk managers navigating this complex space, it is essential to remain critical of the data being consumed and to adopt a measured approach to the selection and use of data within their analyses.

Starting at a macro level with climate risk data and progressing to individual datasets, this panel discussion brings together experts from across the financial sector. They will examine key drivers behind the growing demand for climate risk data and share best practices on how the market can improve data selection, integration and adoption.

Post-event, Fathom will publish a short paper detailing the outcomes of the discussion.

Your panel of experts will be chaired by Fathom’s Chief Research Officer, Dr Oliver Wing, and includes:

Dr Barbara Wortham – Senior Manager in Risk Modeling Services, Climate Risk Team, PwC US

Barbara Wortham is a Senior Manager in the Climate Change group where she focuses on climate risk modeling, climate change, and climate change communication. She has 10 years of research experience resulting in many publications. Barbara specializes in climate modelling and analysis, with specific expertise in terrestrial and historical records of climate change, analysis of earth system models, and programming across a number of computing languages. She also has additional expertise in climate model assumptions, uncertainty, and climate change education. She hopes to helps the general public better understand their exposure to climate risk and mitigation strategies.

Jack Watt – VP, Marsh

Based in London, Jack is a VP in Marsh’s global team responsible for innovating how it supports clients manage their climate and sustainability risks. He has a particular focus on climate physical risk from a supply chain context, as well as wider sustainability risk management.

Geoff Horrell – Global Head of Product, Downforce Technologies

Geoff Horrell is Global Head of Product at Downforce Technologies where he leads the development of natural capital monitoring solutions, including soil carbon and biodiversity analytics. Over the last two decades, he has created and launched a number of technology and data products. Geoff was previously the Head of Innovation at LSEG Labs.

Dr Evan Kodra – Senior Director, Climate & ESG, ICE Data Services

Dr. Evan Kodra leads the R&D team at Intercontinental Exchange’s (ICE’s) Sustainable Finance division. He was formerly the CEO of risQ, a National Science Foundation grant funded spinout of Northeastern University that ICE acquired in 2021. He leads a team of scientists and engineers that build products to empower leaders in the financial markets to respond to climate change and growing socioeconomic inequality. He holds a Ph.D. in Interdisciplinary Engineering from Northeastern University in Boston. His academic research has been cited by the International Panel on Climate Change and has been highlighted by publications including Nature, USA Today, Yahoo!, and MSNBC. His work at risQ and ICE has been highlighted by the Wall Street Journal, Politico, the Los Angeles Times, and MarketWatch, among others.

Report: The role of data – Key to understanding climate risk

Following on from our expert panel webinar, ‘Assessing Climate Risk: The Role of Data’, we’ve compiled a comprehensive report of the findings of the session.