The latest report from Fathom explores key discussion points from our panel webinar on flood risk as a measure of asset value, featuring expert panelists from MSCI, Morgan Stanley, Tata Consultancy Services and TD Bank.

Report: Can flood risk be used as a measure of asset value?

Can flood risk be used as a measure of asset value?

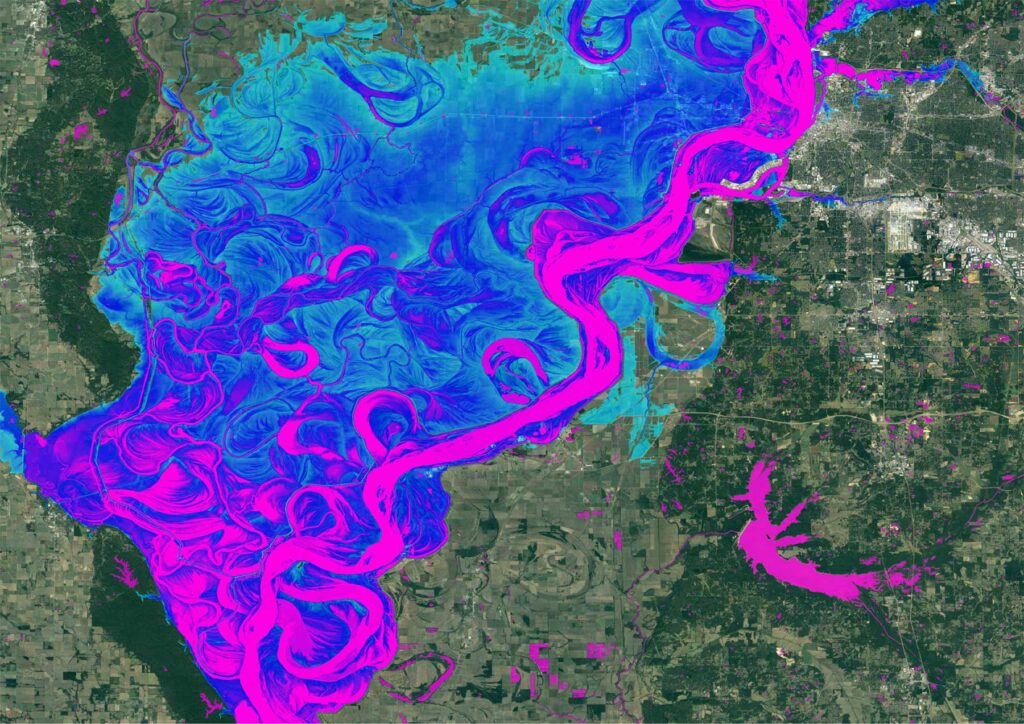

Flooding is one of the costliest disasters. As well as causing direct financial loss, flooding amplifies systemic financial instability, causing insurance to be undervalued, investments to become increasingly vulnerable, and asset prices to fluctuate. As investors and managers seek to make informed decisions and avoid potential losses, it is more important than ever to incorporate flood risk data into due diligence, portfolio screening, and valuation processes.

On September 7 2023, Fathom hosted a session exploring this complex topic. The webinar brought together an expert panel to discuss how climate risk impacts asset value, to explore the increased adoption of flood and climate risk intelligence, and to share perspectives on how flood risk data can be transformed into a pivotal measure of asset value.

This report explores some of the key discussion points from the panel, from the value and uncertainty of climate modeling to the current impact of flood risk on asset pricing.

Sections of the report cover:

— A complex causal chain: Measuring flood and climate risk

— Factoring flood risk data into asset value assessment

— Exploring flood risk at the asset level

Download the report

On-demand: Flood risk as a measure of asset value

Watch a recording of the live event.

Fathom works with firms across the financial markets sector

Fathom’s flood and climate risk data help you to understand portfolio risk, accurately price assets, undertake pre-investment due diligence and respond to regulatory frameworks.