Climate investing will likely be transformative for portfolio management practices. Funds will have to take climate risk into account to raise capital. Incorporating climate risk into both the investment process and the industry’s governance structures is becoming critical.

This IFI Global and Fathom panel webinar casts a spotlight on the evolving landscape of climate risk within investment management. The significance of incorporating climate risk is increasing in the fund management industry and shows no signs of stopping. Investment funds that fail to effectively integrate climate risk factors into their portfolio management strategies may encounter significant challenges in the future.

Recognizing that many within the fund management industry are still navigating the terrain of climate-related matters, IFI Global hosted a panel of industry leaders for a panel webinar and subsequent white paper on this topic, sponsored by Fathom. IFI Global, is a fund management research, media and event business for the asset management industry.

The webinar, on Wednesday 18 October, featured panelists from: Haven Green Investment Management, RiskSystem, IFI Global and Fathom.

Report: Risk in climate investing

In this report, IFI explores the impact of climate risk on investing before providing a structured approach to understanding and integrating these analytics within strategies going forwards.

Info Your webinar panelists

Simon Osborn – CEO, IFI Global

Simon Osborn is CEO and Editor in Chief of IFI Global Ltd. IFI Global is a fund management research and media business, based in the City of London, focusing primarily on the alternative side of the industry.

IFI Global publishes The NED, a publication on fund governance, Sustainable Investment Intelligence, The Tracker, which follows regulatory change in European fund management and FSI, for alternative managers in the US expanding overseas.

IFI Global also undertakes research studies and hosts events on matters related to sustainable investing, fund governance and structural change in the alternative fund industry.

Prior to launching IFI Global Simon Osborn was an Associate Director of the International Herald Tribune (IHT), based in Paris, where he was responsible for the development of the IHT’s asset management coverage. Before joining the IHT he was with HZI International, a media consultancy that specialised in advising and investing in business, financial and medical publications in the developing world.

Paul Price – CEO & Founder, Haven Green Investment Management

Paul is the CEO & Founder of Haven Green. Paul was previously the Global Head of Distribution for Morgan Stanley Investment. Prior to Morgan Stanley, Paul was the Global Head of Institutional business at Pioneer Global Asset Management; he was also a member of the firm’s executive committee and held various directorships. Previously he was head of MFS Investment Management’s non-U.S. Institutional business.

Paul has also served as an associate director on the Fixed Income team at Lombard Odier and held various roles, both as a senior dealer in the treasury division and within the asset management business while at the Bank of Ireland. Paul received a Bachelor of Commerce degree from the University College Dublin and a master’s degree in investment and treasury for Dublin City University.

Dr Peter Cripwell – CEO, RiskSystem

Peter Cripwell, CEO of RiskSystem, started in finance as a derivatives trader at Salomon Brothers and later became the CIO at Pioneer Alternative Investments, a Dublin based multi-strategy hedge fund. After completing a PhD in finance from University College Dublin he co-founded RiskSystem, which provides comprehensive risk, regulatory risk and data management services to funds management companies.

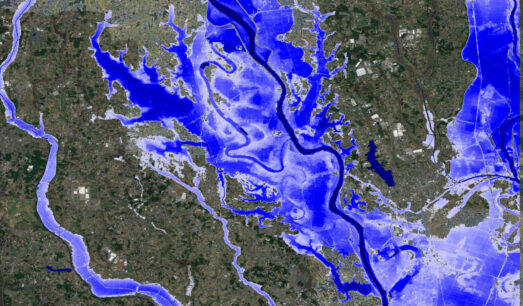

Karena Vaughan – ESG and Climate Risk Lead, Fathom

At Fathom, Karena leads on ESG and climate risk in financial markets. She works with global organizations to enhance intelligence and mitigate the risks of the evolving impact of flooding on their assets, business and customers, helping them determine which products in Fathom’s portfolio are best suited to their needs.

Based in the UK, Karena spends a good portion of her time on the road, primarily in the US attending key industry events, meeting with clients and developing new opportunities for Fathom’s flood hazard risk data.

Karena’s background lies in financial services and ESG, helping organizations make informed decisions about transitional risk to protect their investments as well as communities and the environment. She was drawn to Fathom by the opportunity to marry this expertise with the immediate and physical risk that is flooding. She also enjoys the problem solving aspect of her role; interpreting market trends and opportunities, working with clients to understand their problems, and identifying ways in which Fathom’s data can add value.

Karena has an MBA in International Business from Ulster University and is a member of the Chartered Institute of Securities and Investment.