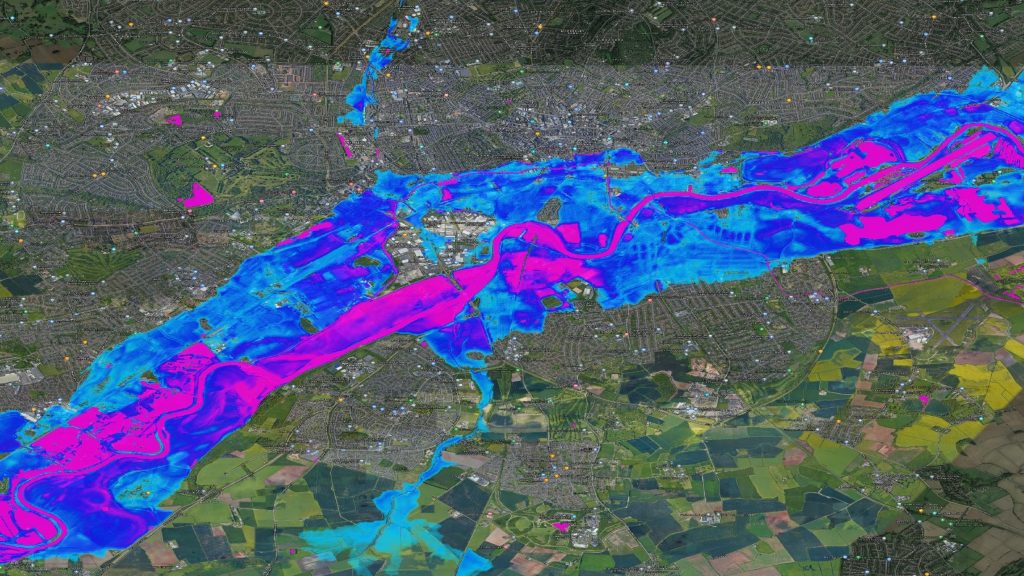

Understand the impact of flooding on your portfolios, for now and in the future.

The Challenge In 2021 the UK’s largest banks, life and general insurers and Lloyd’s syndicates were asked to assess the impacts of the physical and transition risks of climate change. With a particular focus on physical risk, participating bodies were tasked with assessing their financial exposures for 14 perils, under the following criteria:

Three scenarios; Early, Late and No Additional Action

These scenarios are not forecasts of the most likely future outcomes but rather potential future paths that could be taken by the Government and their likely impact.

Risk Assessment for physical and transition risk

This will assess the risk to credit books, assets and liabilities and consider this risk under the following environmental change factors:

1 Warming levels. 2 Sea-level rise. 3 Benchmark Variables. 4 High-level summary statistics for a set of hazard indicators.

Qualitative commentary

Capturing participant’s approaches to climate risk, their views and potential future actions.

Counterparty-level analysis for the UK’s largest firms

Our solution To support participating organisations, we updated our UK flood catastrophe model within the Nasdaq Risk Modelling for Catastrophes platform.

This included producing five discrete climate-conditioned inland and coastal catastrophe models:

Fathom UK CAT CBES – Year 0

Fathom’s UK flood model, climate-conditioned to Year 0 (2020) baseline scenario in the Bank of England CBES.

Fathom UK CAT CBES – Year 10 (EA / LA)

Fathom’s UK flood model, climate conditioned to Year 10 (2030) of the Early Action and Late Action scenarios in the Bank of England CBES.

Fathom UK CAT CBES – Year 10 (NAA)

Fathom’s UK flood model, climate conditioned to the Year 10 (2030) of the No Additional Action scenario in the Bank of England CBES.

Fathom UK CAT CBES – Year 30 (EA / LA)

Fathom’s UK flood model, climate conditioned to the Year 30 (2050) of the Early Action and Late Action scenarios in the Bank of England CBES.

Fathom UK CAT CBES – Year 30 (NAA)

Fathom’s UK flood model, climate conditioned to the Year 30 (2050) of the No Additional Action scenario in the Bank of England CBES.

These were designed to meet the specific requirements of the 2021 Bank of England Climate Biennial Scenarios. Made possible through our partnership with Nasdaq, users interested in assessing their portfolios against these scenarios can sign a one-off CBES data licensing agreement enabling them to run their portfolios for each climate scenario and receive flood risk data within minutes.