AXA: a cutting-edge catastrophe model for Europe

Fathom and AXA have built a state-of-the-art catastrophe model that strengthens AXA’s financial resilience and regulatory reporting.

The challenge The challenge of accurate flood risk modeling in Europe

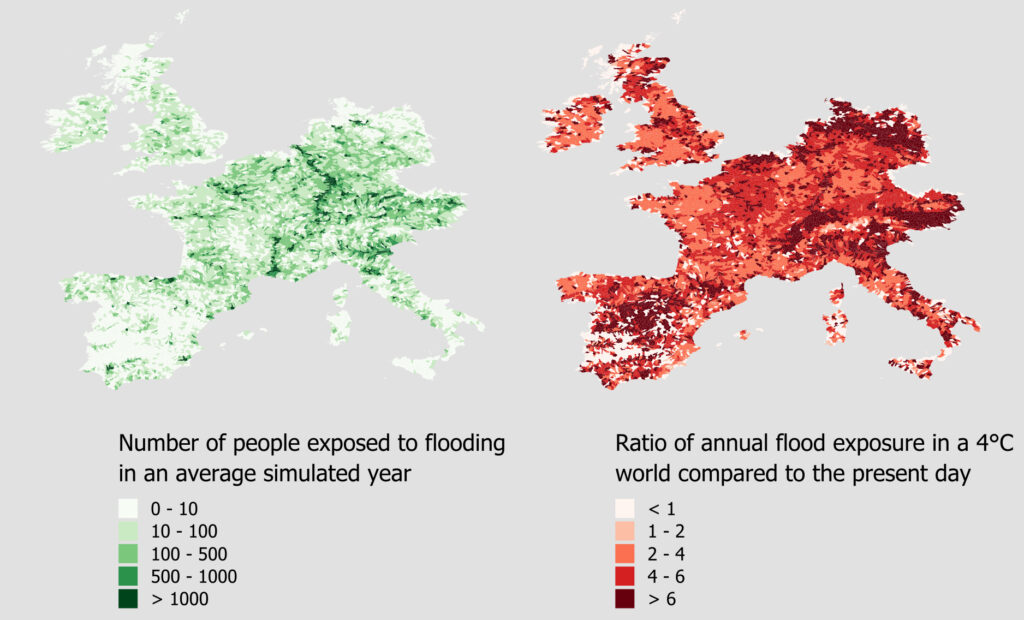

As climate change takes hold, insurers need advanced tools to quantify and understand shifting patterns of flood risk. Such tools are necessary to maintain a resilient business model in the face of growing climate risks.

Europe’s largest insurer, AXA, recognises this need well. In 2020, AXA took the innovative step of developing its own state-of-the-art catastrophe (cat) model for flood risk in Europe.

Its ambition was to portray European flood risk as accurately as possible. And by developing the model itself, AXA could make sure that it met specific business needs. AXA’s development team faced technical barriers, however. Its Climate Analytics and Research Leader, Remi Meynadier, explains:

“Developing a strong flood model is hugely complex. We have tried to do it before for specific country areas. But, quite candidly, we figured out that we needed more hydrological expertise from different parts of the flooding world. This was especially given our plans for a model at the European scale, which is a major task.”

In 2020, AXA put out a tender to find flooding experts to co-develop its cat model for Europe.

The solution Partnering for success: How AXA found the right collaborators

Fathom responded to the tender in partnership with the research institute Deltares. Their bid was successful, amongst 6 other answers to the request for proposal.

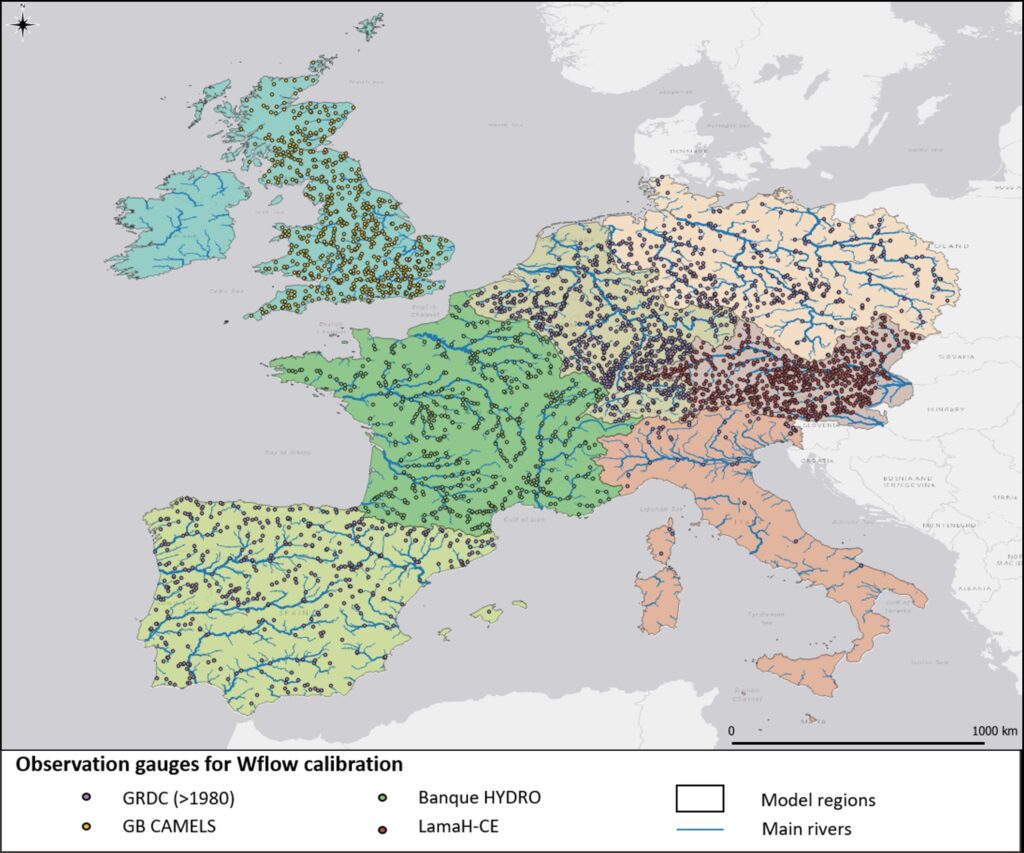

Fathom led the model’s development and sourced the latest, most comprehensive Europe-specific data for flood defenses, river gauges and elevation for a confident, actionable degree of accuracy.

Fathom ensured each of the three partners’ contributions melded coherently. AXA provided weather data and is currently validating the model’s outputs against claims data. Deltares led the hydrological modeling. Further, Fathom developed the model’s initial vulnerability curves, which are used to calculate the extent of financial losses incurred by floods.

The result Empowering AXA’s operations

AXA is set to launch the model in 2024. The model’s comprehensive, up-to-date data provide a reliable view of both fluvial and pluvial flood risk across Europe, under current and future climate conditions.

The model further improves AXA’s understanding of risk through its consistent, pan-European view. It, therefore, avoids problems that come with using multiple uncorrelated models for sub-regions or causes of flood, for example, the challenge of quantifying risks to assets with large, cross-border footprints characterized by both fluvial and pluvial components.

Uniquely, the model allows users to explore the effects of flood defence failure, by showing risk with and without flood defences. Another unique feature is the ability to explore risks under future climate conditions directly from the modelling of precipitations. The model also offers the highest resolution on the market – three meters – for the cities of Cologne, London and Paris.

The development team has validated the model against historical flood events in each country. Fathom, AXA and Deltares will make all validation results and development methods public in a joint research paper (forthcoming).

The model supports several key aspects of AXA’s operations. These include:

- Enterprise risk management. A reliable view of risk helps ensure that AXA has enough capital to cope with losses caused by flood and can support policyholders in the event of major flooding.

- Regulatory reporting. The transparency of the model will enhance AXA’s reports to regulators. Hugo Rakotoarimanga, a research engineer for AXA, explains: “We can understand and explain each and every part of the model. European regulators increasingly require us to delve very deep into climate risks and their effects, and under specific future scenarios. We cannot achieve that using external models alone.”

- Underwriting. In the longer term, AXA plans to use the model to ensure that the prices of insurance policies are appropriate to new patterns of flood risk.

“The transparency of Fathom’s data is very important to AXA. Not only does it help us understand risk very precisely, so that we can better assess and manage it, it also adds value to our regulatory reporting because it allows us to explain the story behind losses.” – Remi Meynadier