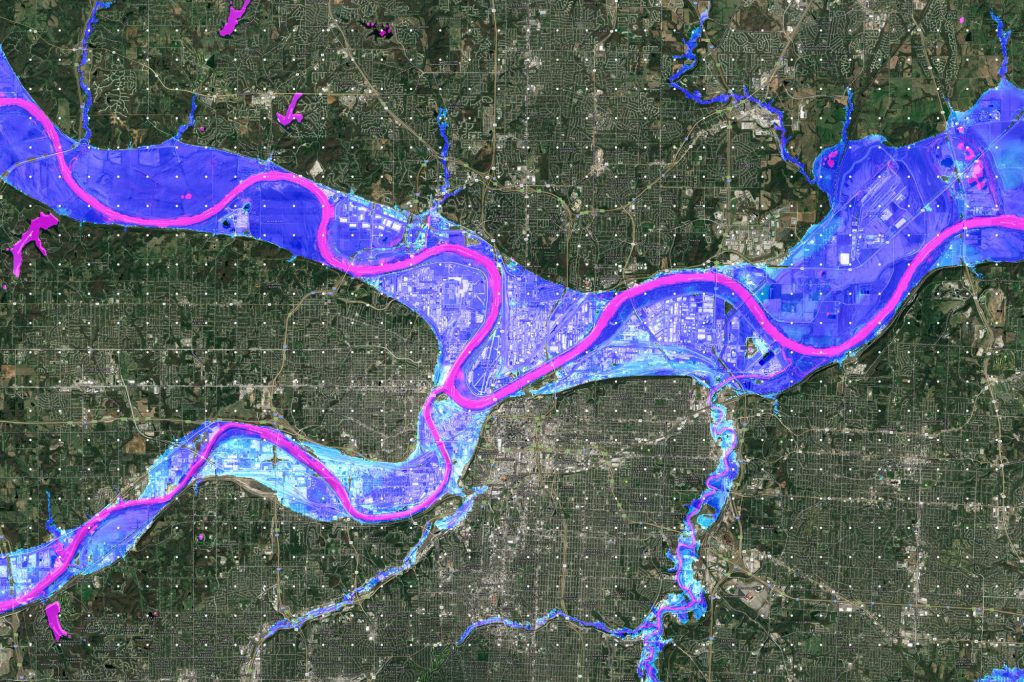

Climate risk tools for financial markets

Flood risk information available for any climate scenario or

regulatory framework up to 2100

Climate change is already impacting business and the value of assets

As frequent and more severe flooding disrupts supply chains, damages property, swamps agricultural land and cuts off energy and transport networks, the risk associated with buying and selling assets will only increase.

The financial implications of climate change are immense, with climate risk being integrated into financial risk management frameworks.

However, increased regulation, external demand for transparency and the need to disclose climate risk requires a level of information that is often missing in ESG datasets.

Fathom can help.

Understand portfolio risk

Consider taking a holistic view of exposure by considering all the properties and assets in your portfolio. This means assessing both direct (asset-level) and indirect (outlying) flood risk.

Accurate pricing of assets

Make sure that the potential for climate-induced flooding is taken into consideration. This means having a clear understanding of the risk posed by floods and the likelihood of their occurrence in specific areas, as well as the costs associated with managing such events.

Pre-investment due diligence

Understand the potential impacts of floods on specific assets and their environment. This includes assessing the physical, economic, legal and reputational risks posed by flooding. The aim is to identify any areas that may be particularly vulnerable to climate-induced flooding and then design appropriate strategies to reduce exposure.

Respond to regulation

Answer any question that you are being asked and conduct all necessary flood risk portfolio analysis using Fathom’s Climate Dynamics framework. Customise the data to fit your regulatory needs, or access one of our recommended climate options – designed to meet regulator requirements..

In a world of uncertainty, Fathom delivers a measure of comfort. We give you:

Truly global coverage

- Understand vulnerabilities to flood risk throughout supply chains and global markets with accuracy, including in developing regions

High resolution

- Pinpoint locations of high-risk assets at a resolution of one arcsecond – that’s 1/3600th of a degree of longitude, or 30 meters

Multiple time horizons

- Get a physically consistent view of flood risk for short-, medium- and long-term time horizons, any year or period up to the year 2100

- Use our past, present and future focused data to analyze evolving trends

All climate change scenarios

- No matter how orderly or disorderly the transition to net zero, you can understand flood risk for any climate scenario and any warming level up to the year 2100 with our Climate Dynamics framework

Fully transparent data

- Know exactly where the data comes from, the methodologies and validation techniques underpinning it and how they’ve been independently assessed for quality

- Understand their inherent uncertainties

Ongoing customer support

- Get the best for your operations – our in-house climate and financial risk experts will talk you through our products, step-by-step and long after purchase

Fathom provides the planet’s most rigorous and cutting-edge water-risk intelligence on the market

We are experts in climate impacted flood risk, the most costly natural disaster. Our global data, maps and models will give you confidence in your physical climate-risk assessments, to help ensure your climate-risk reporting and management:

- are built on solid scientific foundations

- provide the best support for the long-term financial resilience of your organisation or portfolio

- stand up to scrutiny – whether from regulators, investors or board members

- is consistent on a global scale, whether a portfolio’s assets are spread across data scarce and remote parts of the world or in developed nations

World-leading financial service companies and financial regulators use our products to add clarity to their business- and operational-risk management, investment/divestment and capital-allocation decisions.

Unparalleled data quality

Our flood-risk and climate data have been subject to the highest level of scientific scrutiny. Fully verifiable and traceable, our data are expertly compiled by our team of world-leading scientists who collaborate with a global network of independent researchers and academic faculties.

We publish all our data in peer-review journals, including some of the most respected and rigorously assessed titles in the academic world. Our team and their academic publications are some of the most cited in their fields.