This guidance offers seven draft scenarios that will be used by general insurers to assess their financial resilience against extreme events

Update: on May 5th the Bank of England officially launched the Insurance Stress 2022, with plans to release the assessment’s results in September. Fathom’s data has been included in the PRA’s guidance for UK windstorm and inland flood, under Scenario A3. Further details on these scenarios are included below, with the full guidance available here.

In January, the PRA announced that it will be conducting a general insurance stress test for large UK regulated life and general insurers.

The article, which shares the draft scenarios, has asked insurers to offer feedback on each of the plausibility and materiality of the scenarios, the clarity of instructions and the governance and quality assurance requirements. With plans to finalise the document in May, these scenarios assess for two types of risks: natural catastrophes and cyber risks.

For each of these scenarios, participating firms will need to share information on their economic resilience and assess their impact on losses, solvency and profitability under each event. Under natural catastrophes, the Bank of England has included scenarios for hurricanes, earthquakes, windstorms and floods.

As part of this exercise, Fathom contributed inland and coastal flood scenarios that can be used by insurers to respond to the exercise.

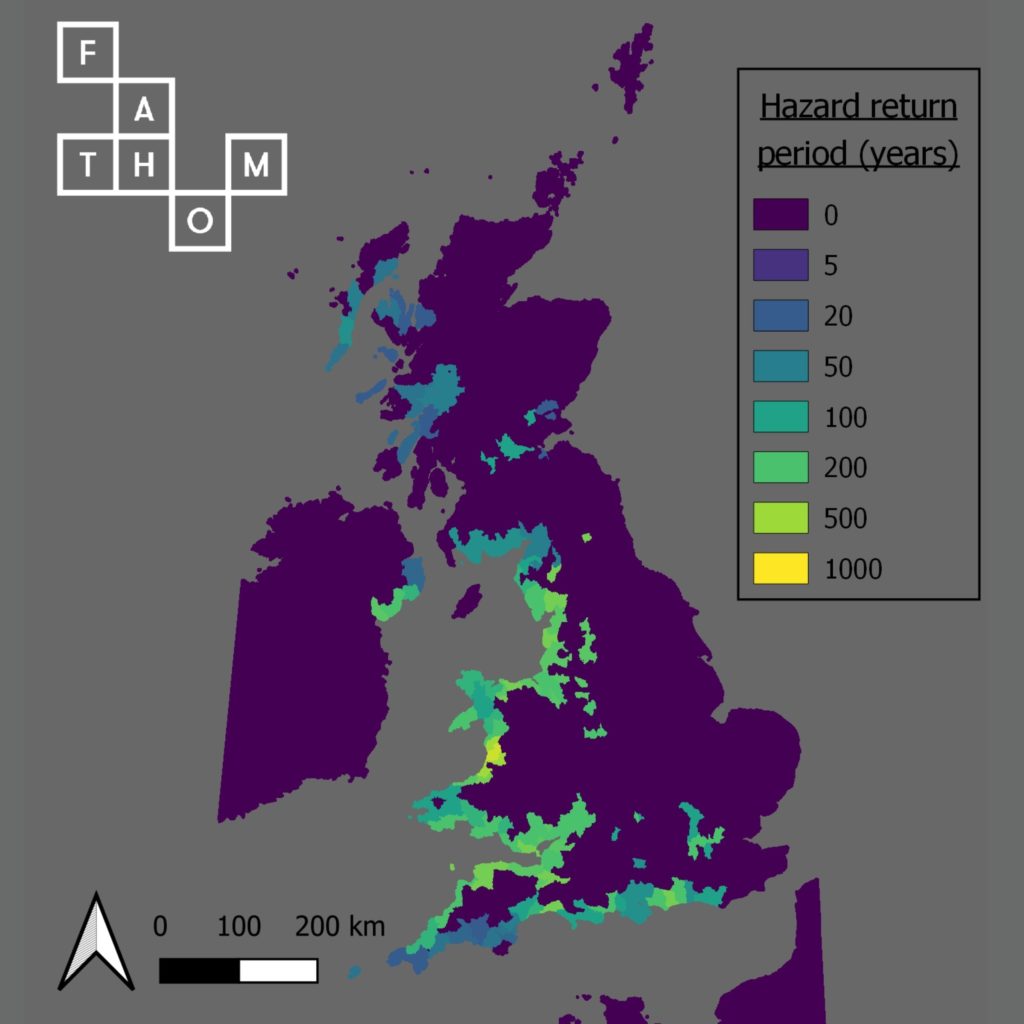

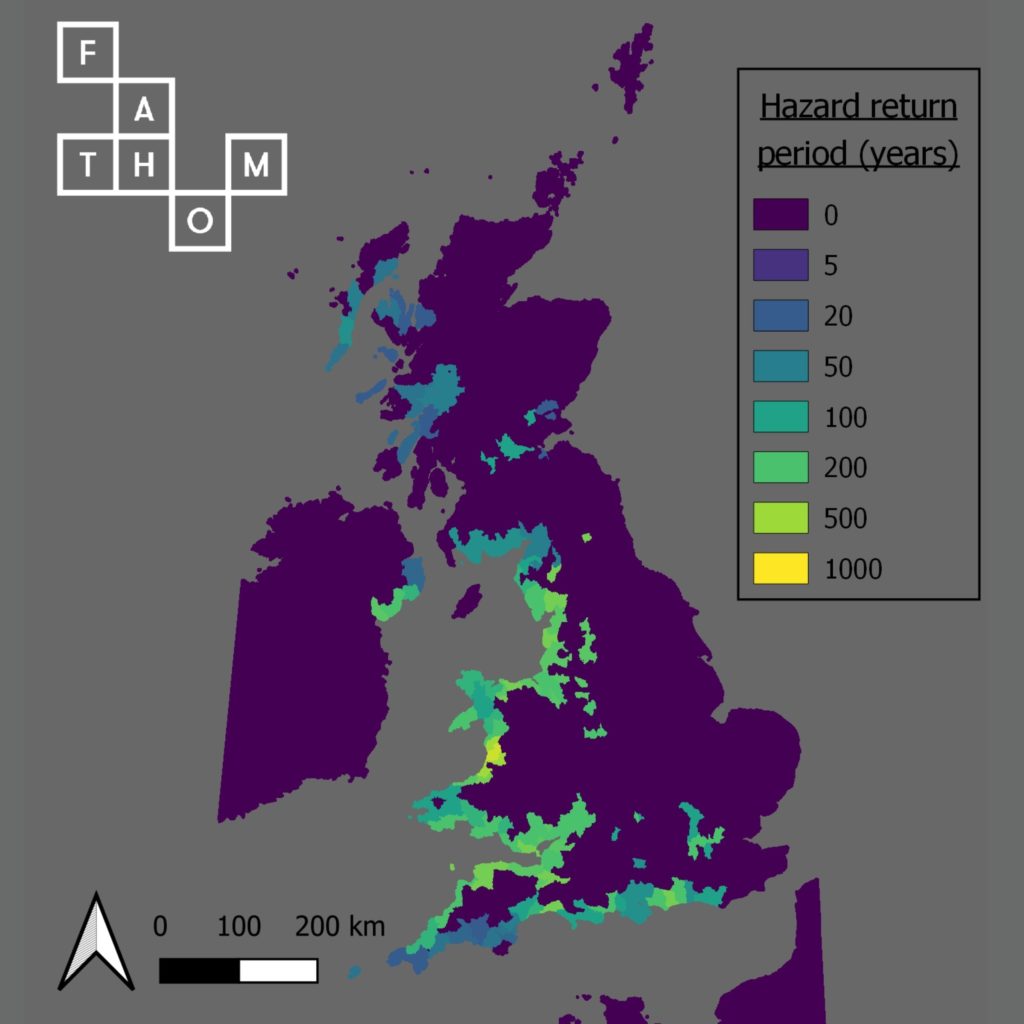

Storm surge: Fathom event ID: 93875

UK windstorm event, resulting in a storm surge along the west coast of England.

Cause: An extratropical cyclone sweeps across Northern England and Southern Scotland resulting in a significant surge across the west coast.

Regions affected: The wind field from this storm is wide-ranging, with the strongest winds impacting the coast between North Yorkshire and Angus in Scotland.

Major losses are driven by storm surges. The Bristol Channel and some parts of Dumfries and Galloway are hit the hardest.

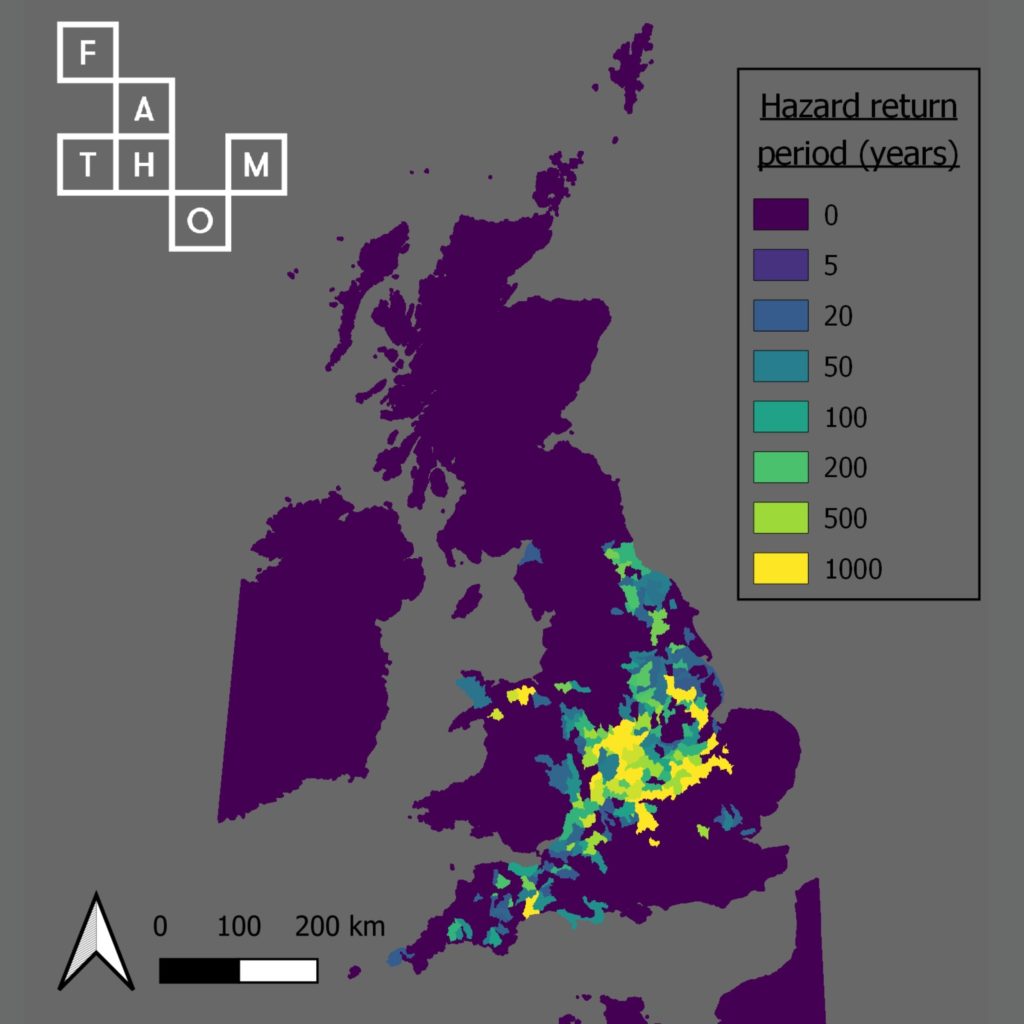

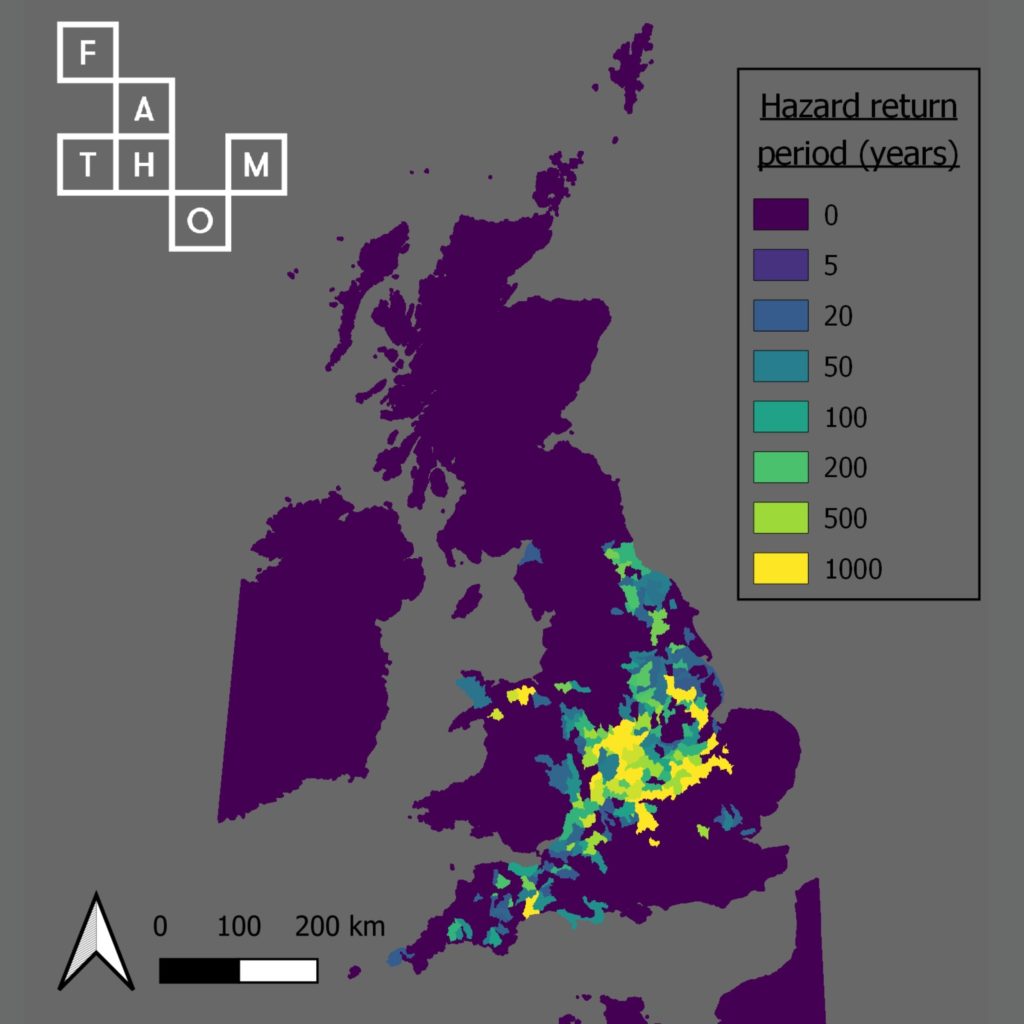

Inland flood: Fathom event ID: 37938

UK inland flood event, impacting an area from Devon to North Yorkshire.

Cause: Extensive inland flooding with a widespread geographic footprint – similar to the 2007 floods.

Regions: This scenario will assess losses beyond the east coast of the UK.

This event is similar to the 2007 flood in terms of the extensive footprint, with widespread inundation from Devon to North Yorkshire with the worst impacts in Oxfordshire, Worcestershire, Herefordshire, Buckinghamshire, and Hertfordshire.

How can Fathom help participating firms?

Insurers have until Thursday 17th March to share their technical input. Once this has been confirmed, the Bank of England will finalise the guidelines in time for assessments in May.

Participating firms can access the scenarios provided by Fathom via Nasdaq’s Risk Modelling for Catastrophes platform.

Insurers can run their portfolios against each event and receive information on event losses using the unique event IDs provided above. For more in-depth consulting and validation of the data, please reach out to Fathom’s technical team, who will be able to offer complete transparency around the methods and features included within Fathom-UK.