Last week, Fathom were joined by David Singh, MS Amlin & Chair of EMWG and Dr Matthew Jones, Nasdaq to discuss how climate conditioned catastrophe models can assist managing agents and the company market with stress testing against climate-related financial risk for CBES and more overreaching, SS3/19.

Agenda

– Introduction and overview by David Singh, MS Amlin and Chair of Exposure Management Working Group

– Nasdaq context and model availability by Dr Matthew Jones, Head of Catastrophe Risk Product, NASDAQ

– Fathom UK Flood CBES model by Dr Andrew Smith, Co-Founder, Dr Oliver Wing, Chief Research Officer, and Olivia Sloan, Technical Consultant of Fathom

– Q&A session

If you missed the event, or are looking to revisit the session, you can download the slide deck here.

Key takeaways

Takeaway 1: Climate risk assessments go beyond CBES

With the CBES exercise underway, it is commonly understood that these kinds of exercises are here to stay and going forwards will likely become established features of risk assessment and financial reporting. There are many formats this might take, such as a scenario-based approach similar to that used for RDS reporting, or a broader and less prescriptive approach such as sensitivity testing by adjusting frequency and severity assumptions within catastrophe models.

The PRA has increased focus on climate change for some years, and the publication of ‘Dear CEO’ last year signaled a shift from awareness to action. The PRA SS3/19 and more recently, Climate Biennial Exploratory Scenarios – CBES, were introduced by the PRA to help manage ESGs and climate risk. For the first round of CBES reporting, the PRA has selected a number of financial institutions to complete this exercise, and although climate risk management can be seen through multiple lenses, and for smaller banks and insurers who were not required to participate in CBES, they will still need to have met the requirements of SS3/19 by the end of 2021.

“(All) Firms should have fully embedded their approaches to managing climate-related financial risks by the end of 2021” – Sam Woods, Dear CEO.

There are a number of use cases for climate conditioned catastrophe models, these include:

– Satisfying SS3/19 expectations – all firms

– Validate existing CBES submissions (due mid-October) – selected firms

– Prepare for future regulatory requirements post-CBES – all firms

– Wider use than just insurance e.g. mortgage book credit risk

Download resource: Stress testing against climate related financial risk – what you need to know.

Takeaway 2: Climate conditioned CAT models are emerging

Nasdaq’s Risk Modelling for Catastrophes platform hosts 12 model vendors covering over 300 different country perils. Of these, Fathom’s catastrophe model for UK flood is the first climate conditioned model to become available on this platform. That said, there are numerous and different climate conditioned models in the pipeline that will be available over the next year or so. These will cover a variety of different climate-related perils including flooding, surge, hurricanes and extra-tropical windstorms.

It is also important to note that when utilising climate data, we need to exercise caution in how this data is applied. As highlighted in Fiedler et al, we have to be aware of the demand being created by the business and finance community for reliable climate information and the potential limitations of what climate models can currently achieve. Whilst the UK has advanced climate data (UKCP) that begins to bridge the gap between climate models and flood models, this type of information is yet to be available for most parts of the world.

Takeaway 3: Flooding is one of the most costliest catastrophic perils… and it’s going to get worse

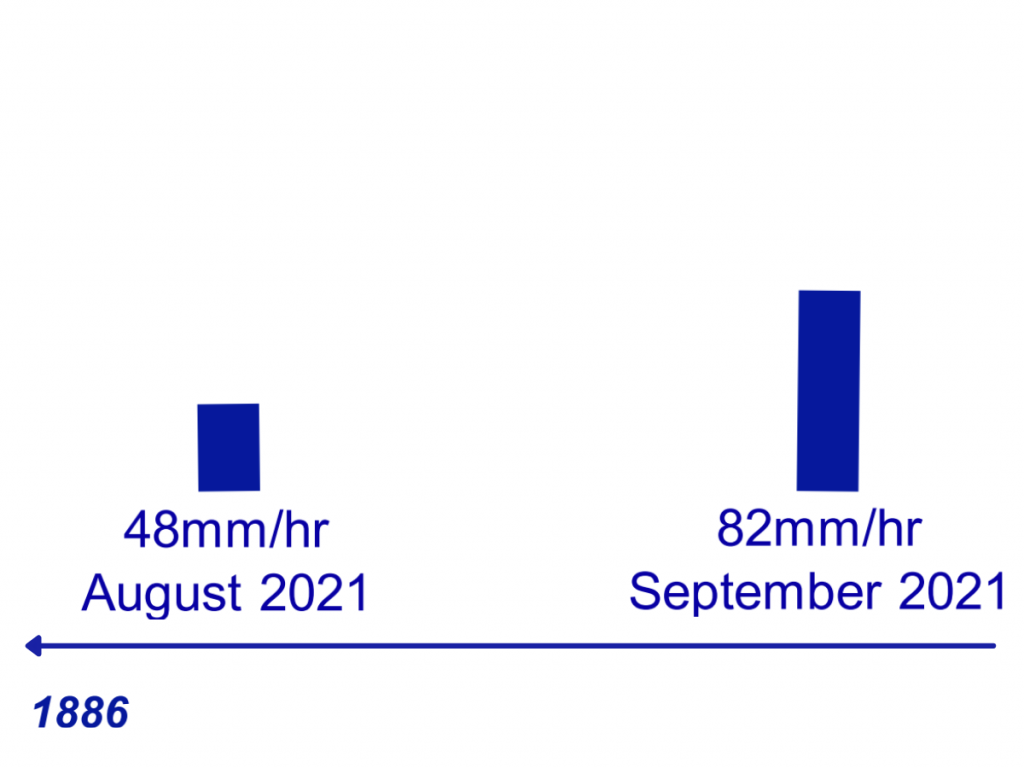

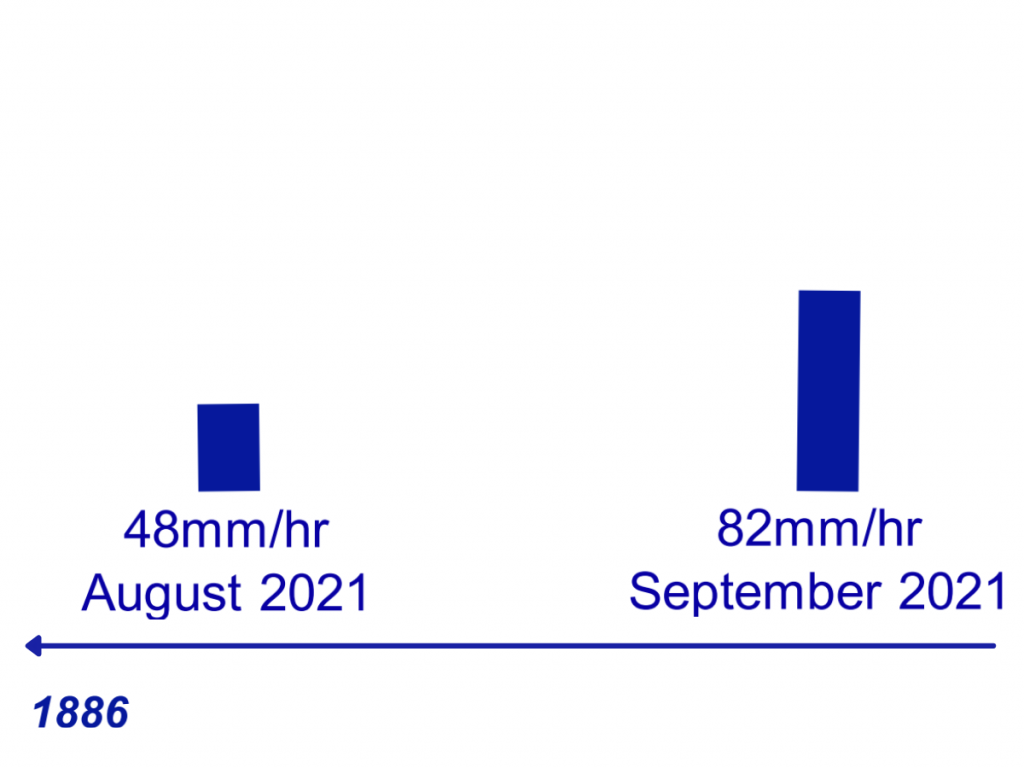

Each year, flooding drives more physical and financial loss than any other natural disaster. When a flood coincides with human activity, the resultant impact devastates communities, livelihoods and infrastructure. What’s more, research universally finds that the severity, frequency and consequential impacts of these extreme events will only get worse (Swain et al). Recent floods in the US have demonstrated this. In fact, New York has broken its record for rainfall two months in a row, with the latter record doubling the record set two weeks earlier.

This demonstrates that we are living in non-stationary times and although climate change has a significant part to play, there are a number of correlated and uncorrelated variables driving the rise in flood risk. In the United States, total flood exposure is expected to almost double by 2100 simply because of urbanisation (Wing et al). This is without considering any potential changes in climate.

Takeaway 4: How can we combat intensifying climate? Well, we can build models

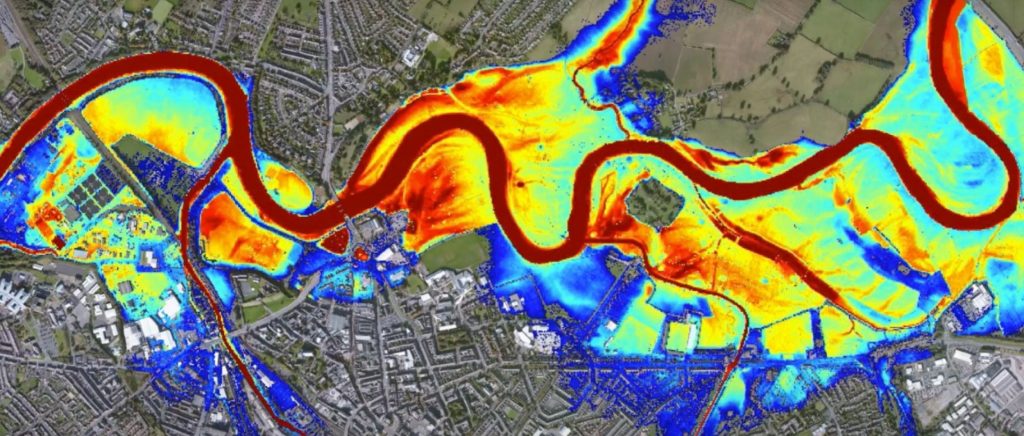

Flood hazard data provide an indication of the magnitude and probability of flooding. The model shown below is a small scale simulation of a flood event in Carlisle (UK) and has been built within error of observations of a real-world event. Computational models like these can provide incredibly accurate representations of flood risk and can be used to identify hazardous areas, build event footprints and even be deployed to forecast events. However, flood models are complex, high resolution and ‘data hungry’ and even building models at small scales requires vast amounts of information. To build larger models that cover entire continents, Fathom have spent many years building algorithms and technology that automates the modelling process.

Whilst we originally set out to primarily work within the re/insurance industry, our models have much wider use. Fathom works cross-sector to establish a view of risk that can be applied to strategy, infrastructure and policies to help mitigate and manage the impact of flooding.

Takeaway 5: Building climate data into Fathom-UK and its “use”

Fathom-UK CAT is the second iteration of our catastrophe model, having originally launched on Nasdaq earlier this year. The model explicitly represents every river channel in the UK, with over 170,000 synthetic flood events built into the model. This covers pluvial, fluvial and coastal flooding, enabling those working within insurance to quantify the financial impact of flooding.

The model is underpinned by the Met Office’s UKCP18 climate models and deploys representative concentration pathways (RCP) 2.6 and 8.5. This has enabled Fathom to produce five discrete climate-conditioned scenarios in line with the three scenarios outlined by the Bank of England. This includes flood risk for the present day, 2030 and 2050 for Early Action, Late Action and No Additional Action. Analysis undertaken on this model has been included in the slide deck (p.26-33).

Fathom’s scenario-based catastrophe models can be used for the CBES reporting exercise directly, or for helping validation of the approach you have developed to complete this exercise.

Outside of CBES, our climate conditioned catastrophe models can also be beneficial for exposure management and pricing functions. We have shared a number of examples in the slide deck (p.35-36), but a key one to mention is stress testing of both exposure and policy terms against future climate scenarios. This can help to define long term strategies – for example, the management of coastal exposure which is exposed to the impacts of urbanisation, sea-level rise, to name a few.

We know that the impacts of climate change will not be felt equally across the globe and that flood is a highly localised and sensitive peril. Future climate views of risk will also be useful for assessing risk aggregation exposed to changing environmental conditions, and Fathom are here to help you with this.

Q&A

Do you create these maps on an ad-hoc basis or do you have a complete view of the UK? In terms of the application, how is the data available?

Fathom currently has global, US and UK flood hazard data available on the market and will be releasing a model for Japan in the next few months. If you are interested in the flood hazard data, then we can provide this through an API. Our US and UK catastrophe models are available through selected partners, including Nasdaq.

Some of the work that we do on an ad-hoc basis are supporting our clients with event response. Just this week we have produced event footprints for Hurricane Ida, which we are offering to organisations on a no-fee basis. You can learn more about this here.

Is Fathom already providing data to firms as part of CBES? If so, what does this relationship look like?

As mentioned in the webinar, we have been working with a large Lloyd’s syndicate to produce flood data for current and future time horizons as part of CBES. For those looking for something similar, we would suggest accessing the model through Nasdaq’s risk for catastrophe platform. All of our models for CBES are available there and you can run your portfolios quickly and easily.

Supporting Resources

Stress testing against climate-related financial risk – what you need to know.

Assessing climate-related physical risk.

Get in touch if you would like to access our flood footprint for Hurricane Ida for free.